Trends Newsletter June 2021

If you would like more information about this topic, please contact us.

Cryptocurrency

Before we answer questions about how many, and which US households (HHs) own cryptocurrency (crypto), first some definitions. According to the "explainer" at Ellevest, crypto "is a form of money that a) isn't issued by a central authority, like a government, and b) uses cryptography—the practice of storing and transmitting data for secure communication." Examples of crypto are Bitcoin (introduced in 2008), Dogecoin (2013), and Ethereum (2015). Secure storage of crypto-transmission data is recorded in a 'block' which is added to a chain of transactions; hence the term 'blockchain.' Crypto is the currency; blockchain, the "technology that supports the currency system." The third definition important to this story is mining. The Economist "explains that the making of crypto requires intensive energy use." To produce new coins for circulation and to verify transactions requires complicated calculations because ever increasingly-difficult cryptographic puzzles must be solved in order to register the latest block in the chain. The process is called 'mining.' Although, crypto mining may sound like a very sophisticated adult computer game, the amount of energy required to play is no joke; it's staggering! For example, during the week of 13 May 2021, Bitcoin mining alone used more energy than the Netherlands consumes in a year.

Crypto may be independent from central authority, but not independent from celebrity influence: Elon Musk demonstrates how he's able to manipulate the price of crypto beginning with his announcement that crypto would be accepted as payment for Tesla, through his tweet stream, and appearance on Saturday Night Live (SNL) when he asked his 54 million Twitter followers if he should accept Dogecoin as payment for a Tesla. The following day, crypto lost more than one-third of its price.

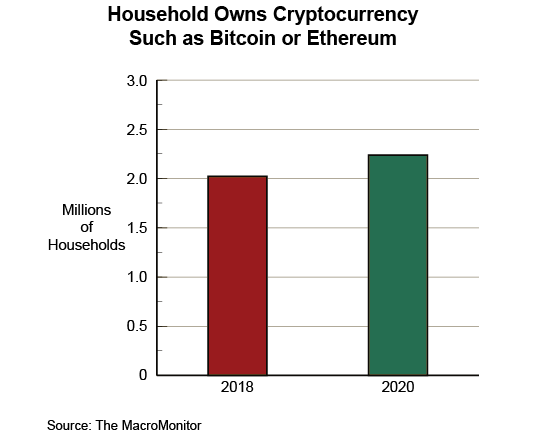

Between 2018 and 2020, the number of crypto-owning HHs has grown by almost one-quarter million, from two million to almost 2.25 million HHs. What do these intrepid crypto HHs look like? Overall, three in five heads are under the age of 45; their mean age is 43 in comparison to a mean age of 54 for non-crypto-owning HH heads. Somewhat more than three-quarters of heads are employed. Crypto-owning heads are almost three times as likely as non-crypto heads to be Asian, and 30% more likely to be Hispanic. And, like almost everything else these days, crypto HHs are economically bi-polar; one-fifth need assistance or are struggling to make ends meet, and about one-third are secure or have more than they need. Typically, crypto households have roughly $1,000 more a month in discretionary income than non-crypto households do ($2,268 versus $1,265).

The buzz about cryptocurrency escalated after Elon Musk hosted (SNL) on 8 May 2021. As anticipated, the Tesla and SpaceX bad-boy-billionaire did indeed cause shares in crypto to dance. Cryptocurrency is a more frequent news feature that makes macro-view reporting like trying to hit a moving target. "Some crypto experts are unfazed by the crash in the digital assets prices, warning that such volatility isn't just normal but to be expected." While investing in stocks carries some risk, buying crypto is very speculative or, as some might argue, a gamification of investing.

Some crypto owners will be influenced by factors such as climate change if for no other reason than the enormous energy consumed in crypto mining. California (where Musk lives) leads in generating electricity from renewable sources. In New York state, the home of much 'mining,' a bill has been introduced recently to cease bitcoin-mining operations for three years, because 70% of the state's electricity is generated by natural gas and nuclear power.

Following China's 2017 ban on Bitcoin and financial-institution exchanges of any crypto business, the United States government is stepping in. The IRS currently considers crypto as "property, not currency, and taxes it as such." With a crypto champion at the Securities and Exchange Commission (S.E.C.), a Bitcoin Exchange Traded Fund (ETF) may be approved by year's end. In the meantime, US Treasury officials may impose new rules on cryptocurrency as part of a strategy to close the tax gap.

Additional deliverables are available to MacroMonitor subscribers:

- The June 2021 Stories: Crypto Households

- The underlying set of data for the June Stories (by request)

For more information, or to have a conversation about households that own cryptocurrency, give us a call or dash off an email to set up a time for a discussion. Contact us.