Why-ology News: Trend Go beyond the what to the why of consumer behavior. April 2017

The Cost of Being Number 1: McDonald's

Brand value equates to shareholder value. McDonald's Corporation common stock that was trading in 2003 for $12 a share is worth $129 a share today. The cost in advertising to stay in the public eye varies by category. For example, in 2013, Apple's ad budget hit $1 billion; the McDonald's 2013 ad budget was $998 million—an increase of 2.9% over its 2012 budget, according to Kantar Media data. McDonald's spending—$2.7 million a day—accounted for 15% of all restaurant ad spending in 2013 (the most recent year for which spending data are available publicly).

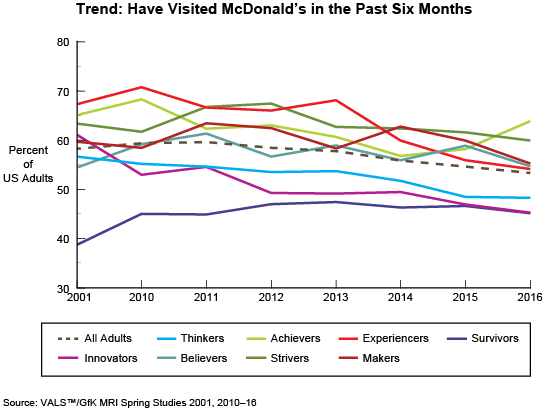

In the United States, the number of patrons visiting any burger/hot-dog fast-food restaurant has declined from 86.9 million in 2010 to 74.1 million in 2016, reports VALS™/GfK MRI spring studies. For McDonald's, six-month visits during the same period have increased from 117 million to 129 million, although the increase has not kept pace with general adult population growth, nor has the percent of visitors increased (59% of adults visited in 2010, whereas 53% visited in 2016). In spite of the decline, 53% of US adults eat a lot of burgers!

Comparing the percent of six-month visits between 2001 and 2016, the erosion for McDonald's tells a broader story. Declining patronage among Innovators (–16%) and Experiencers (–13%) is most notable; these two consumer groups are the most likely groups to say they are trying to eat more healthfully these days. Survivors (+6%) is the only group with a higher percent visiting in 2016 than in 2001; the reasons are the same ones that the February 2017 white paper Trade-Offs: Eating Out cites: rising grocery-store prices and affordable luxury. Achievers visits are currently the most frequent (64%), rebounding from a low of 57% in 2014.

McDonald's aggressive spending is largely responsible for the company's faring far better than its two closest competitors: Burger King and Wendy's. Between 2001 and 2016, the percent of adults visiting Burger King in the past six months declined from 49% to 31%. Declines are across all consumer groups except Survivors; most precipitous declines are among all four high-resource groups: Innovators (–29%), Experiencers (–25%), Achievers (–23%), and Thinkers (–22%). Wendy's has fared somewhat better than Burger King: Visits declined from 31% to 26% for the same years. Visits of Innovators and Achievers are –10%; declines for all other groups are in the single digits. Although Burger King and Wendy's ad-spending numbers are not readily available, restaurant-industry sources suggest that their spending has increased but is not close to the McDonald's level.

What do all those dollars buy McDonald's? Along with constant menu innovation, updated stores, and a sound targeting strategy, those dollars buy recognition as one of the world's most valuable brands. Ba-da-bup-da-ba; i'm lovin' it. Watch McDonald's 2017 Superbowl ad

For more information, companies may contact us.