Trends Newsletter February 2023

If you would like more information about this topic, please contact us.

Missing in Action

Significance:

Growth in the number of unemployed, non-retired men is a significant societal and economic problem.

Summary:

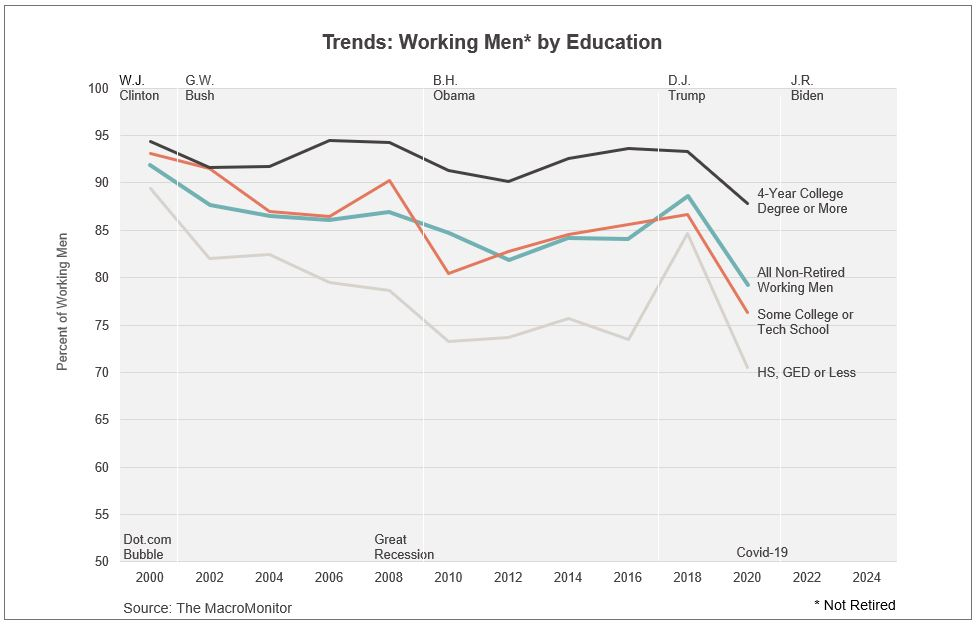

Men and women between the ages of 25 and 54 are in their prime working years. However, the percent of non-retired men in the workforce has been declining since the 1960s when "more than 97% of men... were employed or looking for work" (FRED). Historically, workers with blue-collar jobs moved into the middle-class; a college degree enabled households to move into the upper-class. From the 60s onward the percent of working men has declined particularly for men in blue-collar-manufacturing jobs. In the past two decades, major marketplace disruptions (see graph) have hit Older Millennials' men especially hard. Economists and media give a variety of reasons for these prime-age men to be missing in action—more with criminal records, opioid addiction, improved video-game quality, the demise of the nuclear family, more working women, automation, globalization, and more than two decades of stagnant wage growth. Jobs for able-bodied men without a college degree that pay a wage able to support a family are difficult to find. As a result, men's role as bread winner is diminished becoming a root cause of many societal ills. As college degrees have become ever more necessary to earn a decent living, $2t in debt has been incurred to obtain a credential worth less in the marketplace each year. Meanwhile, colleges have built physical plants focused on STEM that teach few students needed critical-thinking skills while preparing the majority of students for empty, meaningless Bull Shit Jobs.

Trends:

Between 2000 and 2020, the percent of non-retired/employed men declined dramatically (92% to 79%); the actual number has remained flat at 61m. The steepest decline in employment is for men with a high-school degree, GED or less. Four-year college graduates or those with bachelor's degrees or PhDs have decreased least at 6.6%.

Insights:

- The post-Great-Recession labor market was weak while the tech sector was growing. Post-covid, many of these companies are shedding about 10% of their workforce (58,000 in January alone.) The pandemic giveth and the pandemic taketh away. Perhaps the pandemic wasn't the tech-solution accelerant we imagined and instead more behaviors than anticipated are reverting back to 2019. Will a white-collar recession ensue? No wonder the six largest banks are undergoing stress tests. How would a one- to two-year long recession affect your business?

- The New York Times reported in early January that in East Asia, older adults are working well into their 70s because they need the money. This trend is moving West. By 2035, the Census Bureau projects the US will have more adults over age 65 than children under age 18—an historical first. Do you have a 'golden-years' plan with products and services needed by active, mature adults?

- By 2030, 30% of the global workforce will be Gen Z (Zoomers); the majority will be full-fledged consumers in their 20s and 30s. Bank of America predicts Zoomers' incomes will surpass Millennials by 2030; the bank notes that Zoomers will be the "most disruptive generation ever." Well, almost the most disruptive; "tied with 1st Wave Baby Boomers." Both generations are change agents (see Boomers and Zoomers). A long-term innovative strategy will be key to compete successfully with new, non-traditional financial-services providers. How well do you know Zoomers?

- We all know Zoomers are the most educated, diverse generation in US history. The following generation will likely be even more diverse, but not necessary more educated. In 2020 college applications were down across the board. As inflation has taken hold, some students are forgoing college even though a degree might mean higher lifetime earnings. Education never makes it to the consideration set of expenses because some families need the income today, or must borrow to cover cost of living expenses. If higher earnings continue to be dependent on higher education, fewer households may be in a position to buy protection, retirement, savings and investment products in the future. Can your business sustain growth if you have a smaller pond to fish in?

For more information, or to have a spirited discussion, contact us to book a meeting.