Trends Newsletter October 2022

If you would like more information about this topic, please contact us.

Transaction Evolution

For most households (HHs), paying with cash is a thing of the past. In the 1970s, little more than 20% of families owed a balance on any retail credit card. Only 16% had a bank card; by 1977, 38% of families owned one. BankAmericard debuted in 1973; debit cards were introduced in 1975, and Visa (formerly BankAmericard) went national in 1976; Mastercard followed. The 1960s, set the stage, but in the 1970s, Older Baby Boomers drove adoption and use. Plastic replaced cash; its adoption has led to $887 billion (2022) in credit card debt for Americans.

The 2010s set the stage for the next era of transformative change in how goods and services are paid for. Technology, digital dominance, and a new generation of change agents lead the imminent transactional evolution. Today, Peer-to-Peer (P2P) payments, P2B (peer to business), bitcoin, cryptocurrency and online-only banks (neobanks) are gaining traction as payment methods that bypass traditional "middlemen." Retailers are getting back into the payment space too. Presently, online payment tools are experiencing a number of 'speedbumps with regard to government regulation and oversight. Some compliance changes have already been made, but by the end of the decade, use issues will be resolved simply because of market demand. In the meantime, traditional banks are in jeopardy of becoming irrelevant. Younger Millennials and members of the Gen Z cohort are driving the change to contactless payments. Today, you can leave home with your cell phone and driver's license and go anywhere; in states that have digital drivers' licenses, all you need is your phone. Of necessity, anti-fraud and theft protections will continue to increase in importance.

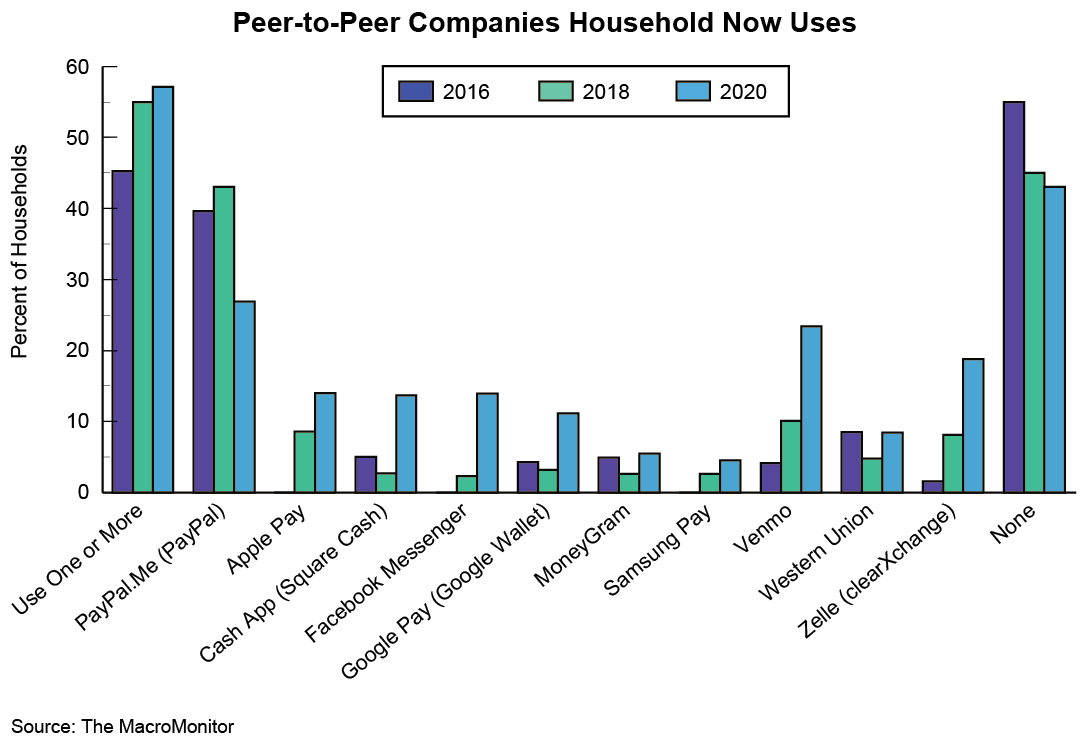

In 2020, more than one-half (57.1%) of HHs have used a contactless payment system, an increase of more than twenty-percentage points since 2016. Winners and losers in the sector are becoming clear—Venmo and Zelle being the two most obvious winners. Some new players, such as Apple Pay and Facebook Messenger (not asked in 2016), have picked up some share. The 2016 category killer, PayPal's share has changed due, in part, to a response change to PayPal.me. HHs with Younger Millennials and Gen Z (Zoomers) heads are more likely than all HHs to use all P2P services other than Facebook Messenger, Moneygram, PayPal and Western Union.

Direct-pay use depends on exposure, comfort with technology and need. The older the cohort head, the less likely HHs are to use one of the systems; the younger the cohort, the more likely the HH is to use a P2P provider. Overall, that not a big surprise. What is a surprise is the rapidity of the change. Differences in attitudes and behaviors, not the difference in demographics between members of Gen X and Youngest Millennials, are responsible for the changes.

Since the youngest HHs are driving changes in just about everything, including financial services, the benefits of understanding them should be of paramount importance to you. Being online is, simply, not enough. HH attitudes among Young Millennials are not in your favor. They are the consumers most likely to distrust you and avoid talking to you. In other words, some financial-services providers (depositories) are at risk of becoming disconnected with the next generation of consumers.

We know much more about Young Millennials. We're happy to share. All you have to do is to be in touch. Contact us to set up a time to call, Zoom, or WebEx.