Trends Newsletter May 2022

If you would like more information about this topic, please contact us.

Risky Business

Which of your customers are you at risk of losing? Most consumer-facing companies ask about the customer satisfaction of every transaction—"recommend" questions are frequently included in a survey. Apparently, there is a constant need to make sure the company is receiving good grades; not nearly as much effort is spent on figuring out how to make the grades better.

Satisfaction is difficult to measure because questions rarely define what constitutes satisfaction; satisfaction means different things to different people. These days, the most important reason to avoid using customer-satisfaction surveys is that the majority of consumers are burned out by being asked to complete one after every interaction or transaction. Customer-satisfaction surveys have outlived their usefulness as a means by which to improve customer experience.

Was your customer satisfied? Was the customer's expectation met? Would the customer recommend you to a friend? Was their experience with your organization positive? Answers: Maybe; Maybe; Maybe; and It depends. What you really need to know is: Is the customer looking for another provider? That information is a more reliable measure than a net-promoter score derived from convenience samples! How many (and what types of) households (HHs) are frequently or actively looking for a different provider? Which HHs would consider, or are thinking of, switching providers? All of these HHs are in play and represent a serious risk to maintaining your current level of business, much less expanding it.

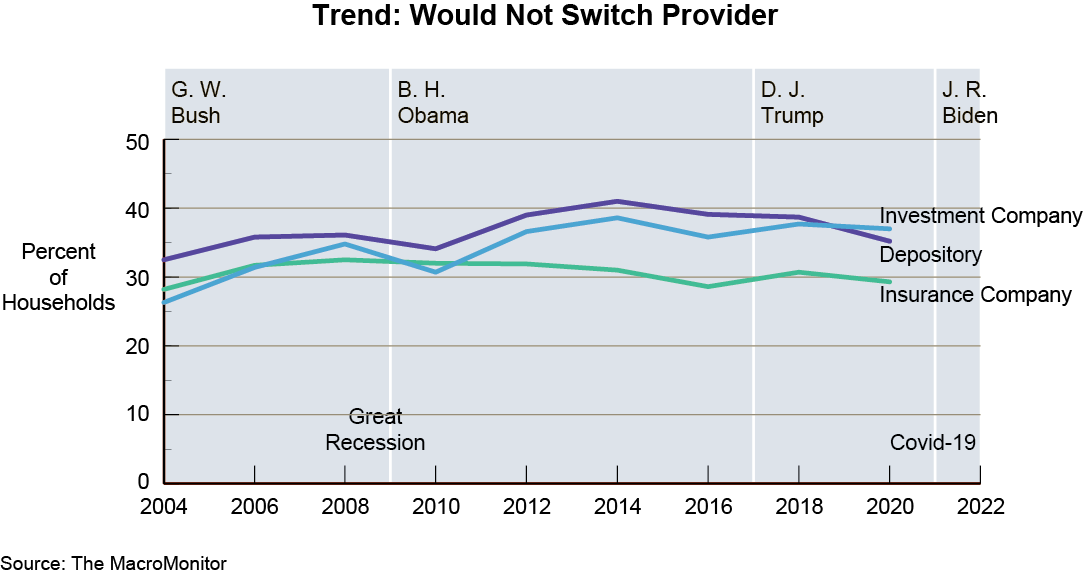

Basically, all HHs (98%) have a primary depository; just over one-third (47.5 million) would not switch providers. If you are a depository, this means two-thirds (87.4 million) of your customers are at risk of switching providers—roughly 7 million customers are actively looking for another relationship.

Almost all HHs (90%) have an insurance company. Among them, only 38.6 million would not switch their primary insurance provider—double that number (77.5 million) would consider another relationship; in addition, 8 million HHs are actively looking.

Roughly one-half of HHs have an investment company (stockbrokerage, mutual-fund company, or financial-planning company). Almost one out of four (25.7 million) HHs would not switch their primary provider; 41.5 million HHs are not fully committed to their provider; and 2.4 million are actively looking for another services provider.

Switchers are derived using a five-point scale: I would not switch to another institution; I doubt I would switch...but would consider what another institution has to offer; I would definitely think about switching...if it had something better; I frequently reevaluate my primary institution as the one I should be using; and I am actively looking for a new institution.

In the world of financial products and services, historically, inertia has been an important deterrent for customers to change providers—a boon for customer retention. In combination with the relatively slow-moving pace of industry change, financial-services providers have had the luxury of being reactionary more than a need to be visionary. The status quo is changing because:

- Money-flows and new product introductions are increasingly global, and money-flows are subject to disruption

- The internet and Amazon have changed customers' expectations and experience standards

- Younger consumers are less loyal and more interested in the latest new thing (crypto and de-fi, for example) than are more mature households.

Customer satisfaction is increasingly important to every organization because, in the words of Amazon founder Jeff Bezos, "If you make customers unhappy in the physical world, they might each tell 6 friends. If you make customers unhappy on the Internet, they can each tell 6,000 friends."

Given a choice, and easy access to other providers, unhappy customers simply won't return. The internet makes it easy to find every possible option (often independently rated) by computer, tablet, or smartphone.

Stop playing defense! What's your plan to retain the customers you're most at risk of losing? The first step is finding out who they are; the second is to find out what products and services these HHs most likely need. The MacroMonitor can answer both of these questions.

Contact us to set up a time to chat.