Trends Newsletter October 2021

If you would like more information about this topic, please contact us.

Hard Choices Ahead

In 2018, a Pew Research study confirmed what most Americans already knew. Even with unemployment numbers lower than in two decades, wage growth was lagging except for the top tier of workers. Factoring for inflation, average real wages had the same buying power as they did four decades earlier; many households have been facing hard financial choices for quite some time. In the past 20 months, choices for some households have become more difficult because of Covid‑19. The pandemic is forcing households to reckon with their financial future; hard choices will remain.

As wages stagnate (for all but the top tier of workers), buying power erodes. A July Forbes article addressing the real reasons the country is experiencing labor shortages cites the federal minimum wage as an example of stagnating wages: In 1968, $1.06 an hour; in 2021, the equivalent would need to be $12.38, not $7.25 (the current federal minimum wage). For the United States to emerge from the pandemic stronger than before, wages need to catch up and the number of middle-class households needs to increase. Financial institutions are uniquely positioned to help aspiring middle-class households build wealth, whether through education, counseling, homeownership, or retirement products, and assist existing middle-class households not to misstep or take a backward step.

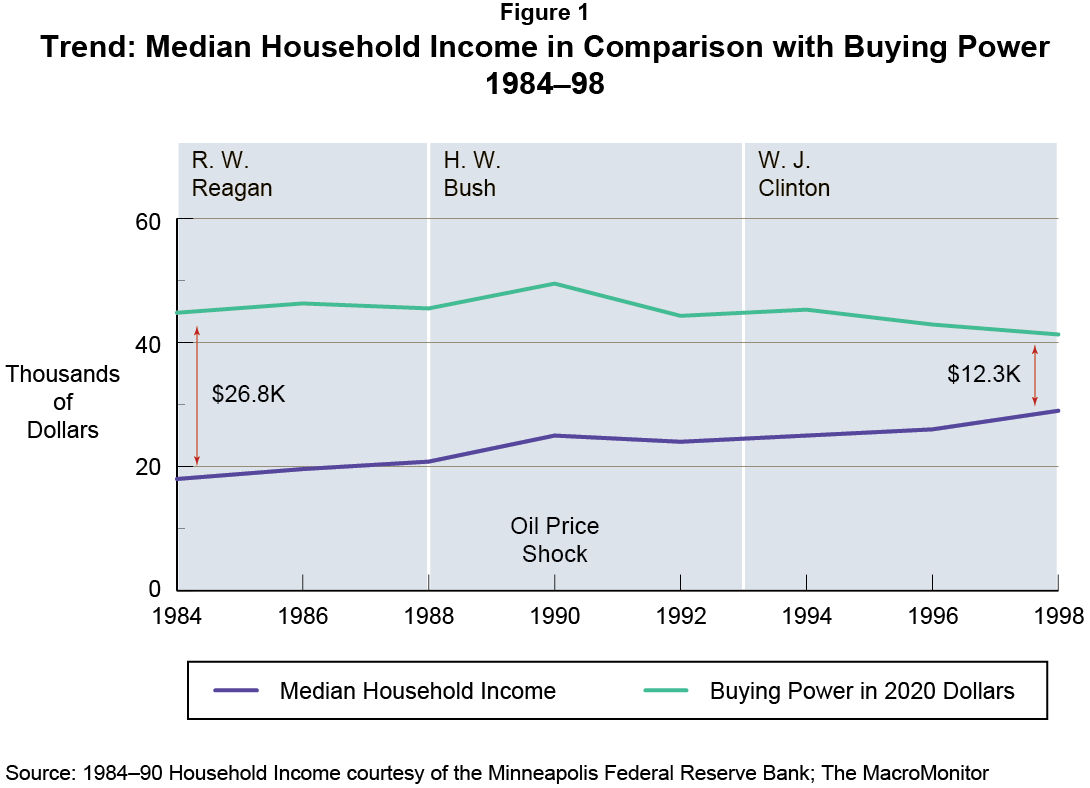

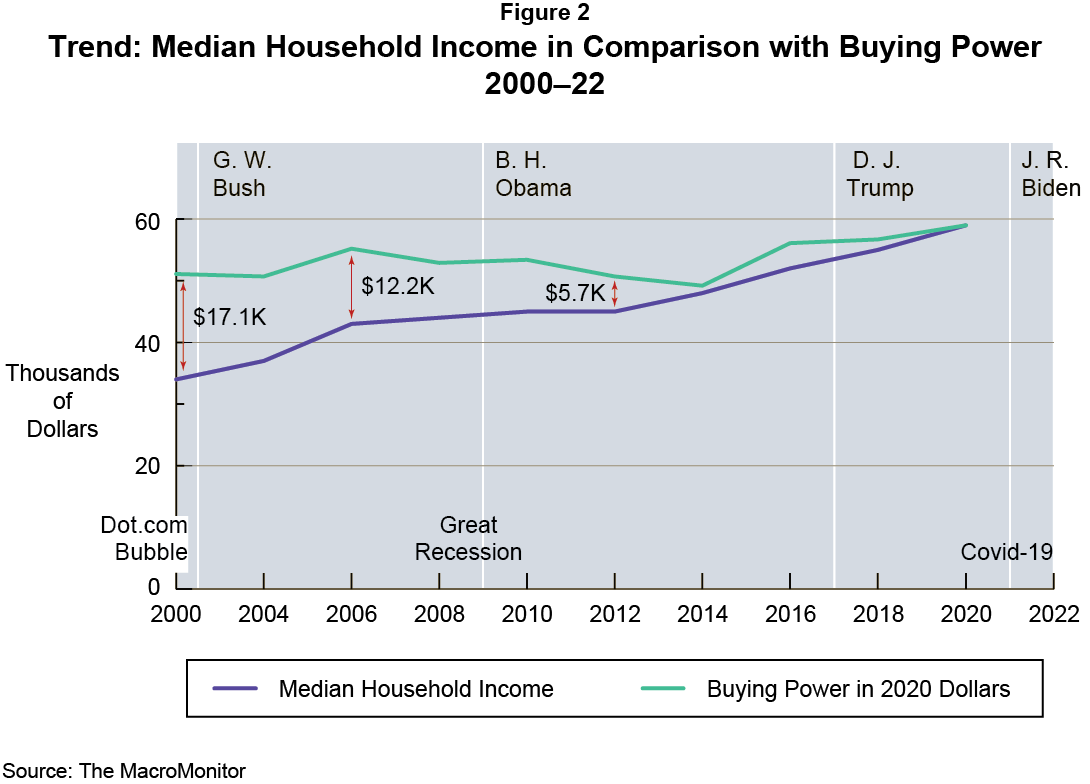

The figures below illustrate the gap between household buying power and median household income. Discretionary income has disappeared.

Currently, twenty percent, or 27.5 million households, have no discretionary income. Reflective of all households, in September 2021, The Conference Board reports that consumer confidence (the opinion of how well the country's economy is doing) fell from what it was August, and consumer sentiment (feelings toward personal financial health) shows economic prospects less favorable than they've been in a decade (Trading Economics).

The country has a window of opportunity in which to recalibrate expectations on the basis of a reality check. Studying the numbers is critical, but it's more enlightening if one remembers that the numbers represent people—people have hopes and dreams for a better future. Because people need financial services to build their lives, only financial-services providers can help households fulfill wishes and make their dreams become tangible.

When your need is to see the entire picture of where households stand, a source that contains all household information (resources, goals, responsibilities, preferences, and relationships) in a single-source database is essential. Smart decision makers use proven tools and strategic partnerships upon which to create their targets, to strategize, and to build workable solutions for households with competing needs.

Both broad thinking (a macro-view) integrated with data (a micro-view) are necessary. The MacroMonitor provides both—precisely the tool you need. As we work toward a post-pandemic society, consider a subscription to the 2022–23 MacroMonitor: It's an easy decision because the study is a genuine value.

Additional deliverables are available to MacroMonitor subscribers:

- The October 2021 Stories: Median-Income Households

- The underlying set of data for this month's Stories (by request)

We're interested in hearing from you about your needs. To have a conversation, give us a call or shoot us an email to set up a time for a discussion. We're easy to reach.