Trends Newsletter February 2021

If you would like more information about this topic, please contact us.

Affluent Black Households

The current conversation about income inequality has a focus on the poorest members of American society—many are Black-American households. But what about Black households at the other end of the spectrum? In 2020, Forbes Magazine reports that seven out of 614 US billionaires are Black. Despite discrimination and sometimes poverty, the seven are all self-made billionaires. The top two names on the list are business entrepreneurs (Robert Smith and David Steward), one sports figure (Michael Jordan), and four who started as entertainers (Oprah, Kayne West, Jay-Z, and Tyler Perry). Sports and entertainment are the two most racially diverse business sectors because extraordinary talent is more easily recognized and financially rewarded than in other sectors.

Black-headed households (HHs) represent 13.7% of all US HHs (140.8 million). Of Black-headed HHs, 21% have a Net Worth (NW) of $250K or more; 9% have an annual household income (HHI) of $150K or more. To understand the full measure of the gap between Black and White HHs, 47% of White HHs have a NW of $250K or more and 17% earn an annual HHI of $150K+.

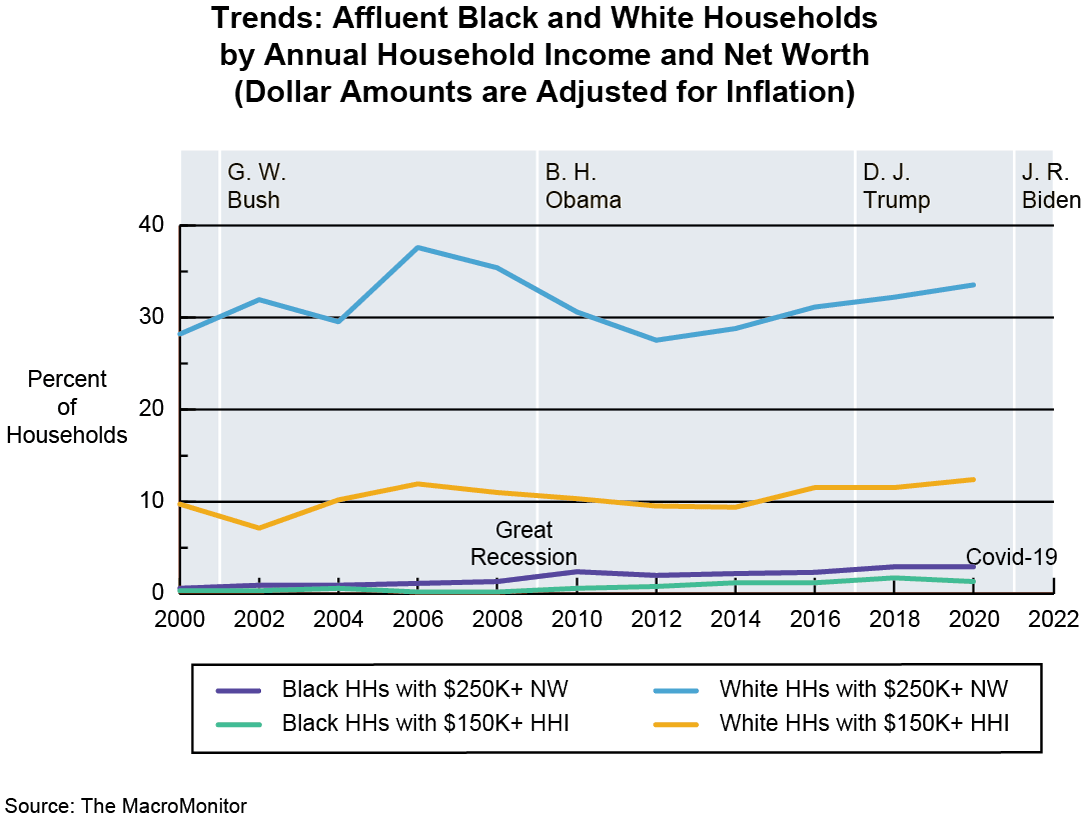

The proportion of Black HHs with a net worth of $250K or more has increased between 2010 and 2017 from 1.3% to 2.9% and has remained the same since that time. In comparison, the proportion of White HHs with a net worth of $250K or more (hit hardest during the Great Recession) has still not recovered to the 2006 pre-recession level of 37.6%; the proportion of these White HHs increased since 2018. Further analysis may show that White HHs with the highest net worth grew disproportionately in comparison with White HHs at the $250K floor.

Households with an annual income of $150K or more represent 9.7% of total Black HHs and 18% of total White HHs. The proportion of Black HHs in this income range increased from 0.2% to 1.7% between 2009 and 2018 but has declined in the past 2 years to 1.3% under Trump. The proportion of White HHs with incomes of $150K or more increased from 11.5% to 12.4%, an increase of almost 1.4 million HHs.

Our Kind of People by Lawrence Otis Graham (1999) provides an insider's look at the small but influential Black-American elite who enjoy invitation-only social clubs often devoted to "shaping children into future leaders in business, society and politics." Kamala Harris and Cory Booker are reportedly beneficiaries of such organizations as the Jack and Jill of America Society which claims 40,000 members. Chapters are certainly present in the richest Black communities; five of the top ten are located in Maryland (three in California, one in New York, and one in Texas).

Differences in financial product ownership and use between affluent Black and White households are distinctive not on the basis of the product mix, but rather on the amounts in the accounts. Many financial attitudes are similar with some notable exceptions about planning, protection, and borrowing.

Blacks and Whites have different life experiences that shape both financial and non-financial attitudes. For example, a person who is often the 'only' Black person (or the 'only' woman) at the table experiences a higher level of stress to meet or exceed others' expectations than if one looks like the majority of their business colleagues and acquaintances.

Marketing (sales, service, and communications) to affluent Blacks is not the same as marketing to affluent Whites. Historically, there are many ways that the financial-services industry has not been inclusive to people of color. Recognition of past shortcomings is needed to build trust in the future. Credit Unions are better positioned than banks to build trust, in part because they're local and in part because they create a sense of community and belonging through membership. Long-term relationships are built better by individuals than institutions. That said, a strong online presence is important since affluent Blacks are not only proficient users, but also because the internet is color blind.

Learn more about the differences between Black and White affluent households and how your institution can help close the wealth gap. Doing so will not only increase your business but could also raise our country's GDP by 4% to 6% by 2030—a benefit for all!

Additional deliverables are available to MacroMonitor subscribers:

- The February 2021 Stories: Two Affluent Black Households

- The underlying set of data for February's Stories (by request)

For more information, or to have a conversation, please be in touch. We're easy to reach.