MacroMonitor Market Trends Newsletter April 2020

If you are not a MacroMonitor sponsor but would like more information about this topic, please contact us.

Trust in Financial Institutions

One might think of trust as the measure households use to rate their financial institutions and intermediaries—similar to FICO scores that financial institutions use to rate consumers' credit worthiness. Scored on a three-point scale (a great deal, some, and hardly any), trust indicates to what degree the consumer has an emotional connection with, and can rely upon, a provider. Trust relates directly to brand reputation and customer loyalty. A data breach, an unethical or unfair customer or employee policy, a poor customer experience, regulatory non-compliance, or unacknowledged and uncorrected problems (individually and collectively) damage consumer trust.

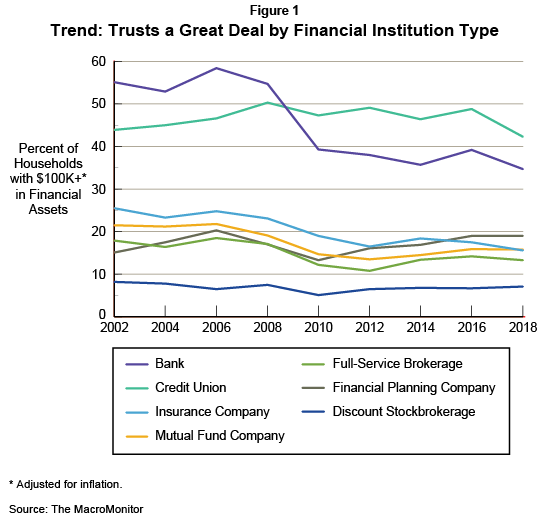

The MacroMonitor provides subscribers with a means to look at trust any number of different ways. For example, a trend of households with $100K or more in financial assets ($100K+FA HHs) that trust financial institutions a great deal by type of institution shows that between 2002 and 2018 for all institution types (with the exception of financial-planning companies), the proportion of households that trust-a-great-deal (TGD) has declined. Bank TGD has decreased the most—20 percentage points—to a more modest decline of only 2 percentage points for credit unions. In 2018 credit unions have a higher proportion of households that TGD than do any other institution type.

Between 1994 and 2018, (net) TGD scores for both institutions and intermediaries has declined. Institutions' TGD score decreased by 21 percentage points (from 73% to 52%). During the same time period, intermediaries' TGD score has fared worse, with a decrease of 32 percentage points (from 68% to 36% of households).

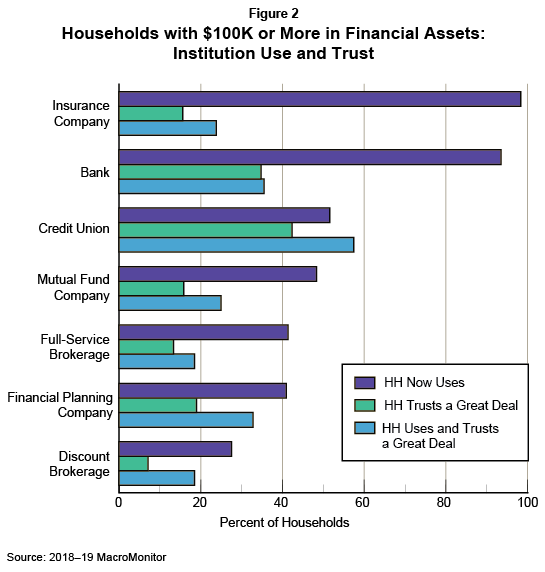

To illustrate the importance of TGD scores to your business, we compare by institution type, the proportion of households that now use each, all households that TGD, and households that now use and TGD. In every instance, use of an institution increases trust. Why is this so important to providers? Because use and trust together produce greater loyalty and likelihood of recommendation.

Consumers are strongly encouraged to check their credit score annually; institutions and intermediaries should check their TGD annually as well. Doing so could alert an organization to a potential problem, or serve as a scorecard to inform improvement to your institution's valuation and profits. The MacroMonitor provides an important, impartial third-party look at households that TGD and can compare different institutions' loyal consumers.

Additional deliverables are available to MacroMonitor subscribers:

- The April Segment Summary: Trust: Financial-Planning Companies

- The underlying set of data for this Segment Summary (by request)

The MacroMonitor provides fact-based information to identify, profile, and understand household populations better. For more information, please contact us.