MacroMonitor Market Trends Newsletter August 2019

If you are not a MacroMonitor sponsor but would like more information about this topic, please contact us.

The Impending Long-Term-Care Crisis

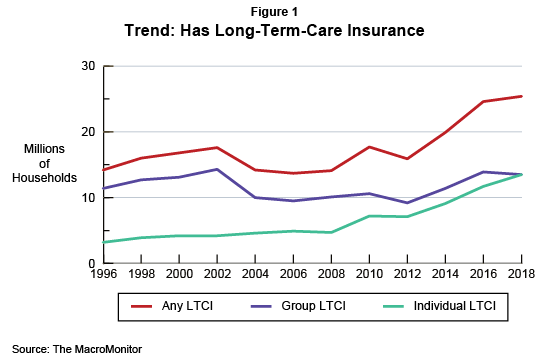

More than half of US citizens turning 65 today (52%) will need long-term care sometime in their lives, according to an AARP Public Policy Institute report on long-term-care support and services. Because roughly 10,000 Baby Boomer household heads are turning age 65 every day, the magnitude of need for care and support services will increase dramatically in the next decade. In spite of an increase in the number of households with long-term-care insurance (LTCI), LTCI coverage of this aging population faces a significant deficit, necessitating coverage by other means.

Given the actuarial realities that half of all household heads age 65 years and older face, increasing ownership of LTCI is a step in the right direction. Nevertheless, policy ownership remains much lower than the need for protection. Cost is the reason that 47.5 million households give for lacking coverage—and LCTI may seem to be expensive. However, the cost for purchasing LTCI now is much less overall than what the actual cost of services and support will be without LTCI. About 28 million households say they have no current need—specious reasoning, because when the immediate need materializes, the household will be unable to secure LTCI. Annual policy cost escalates the older one is at time of policy purchase.

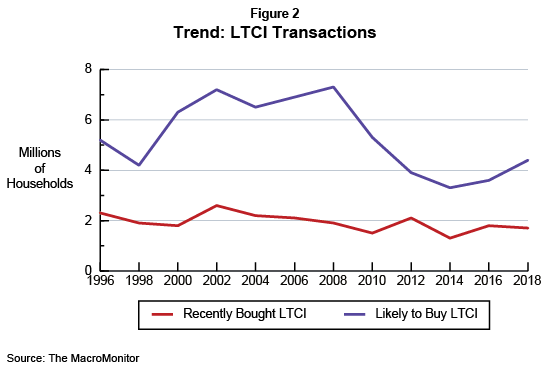

Recent LTCI sales—sales in the past two years—have been relatively flat for the past two decades. The good news is that, after significant declines since the Great Recession, interest in obtaining long-term-care Insurance is starting to increase. Somewhat more than 16 million households suggest that if LTCI were available at their place of employment, they would consider obtaining coverage.

The MacroMonitor uses externally validated survey results to identify, profile, and understand select households. Financial providers can use this comprehensive knowledge to derive better insights and provide more effective products and services to meet people's financial needs. For more information, please contact us.

Subscribers have access to this month's Segment Summary: Households Likely to Buy Long-Term-Care Insurance. Subscribers may request the underlying set of data for this Segment Summary. For more information, please contact CFD today.