MacroMonitor Market Trends Newsletter September 2018

If you are not a MacroMonitor sponsor but would like more information about this topic, please contact us.

Vehicle Leasing

Clients may access the September Segment Summary: Will Households That Currently Lease a Vehicle Lease an EV?. A copy of the underlying data in an excel spreadsheet is available to MacroMonitor subscribers upon request.

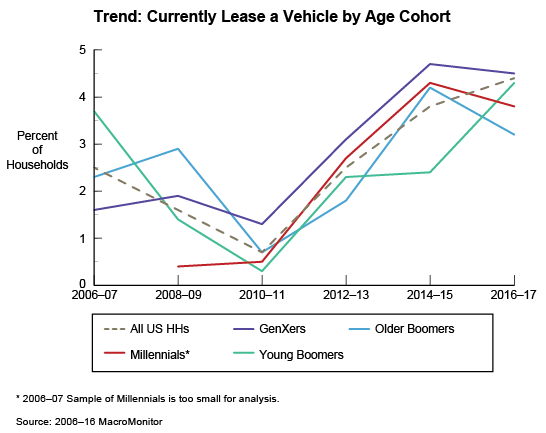

Since the 2008 Great Recession, vehicle leasing has been on an upswing. The ready availability of compact cars, sport-utility vehicles, and trucks in the new-lease market; low consumer interest rates; and attractive leasing deals to keep used-car supplies steady and resale values high have been fueling lease growth. Several market factors suggest this trajectory will continue: rising vehicle costs, Millennials' aversion to ownership, and the pace of hybrid, autonomous, and electronic-vehicle (EV) adoption. The interplay of these factors offers both opportunity and challenges to financial-services providers—especially lending institutions and insurance companies.

People lease vehicles for various reasons: to drive a status brand, to have the vehicle that meets their needs best, to have dependable transportation, or to drive the latest in vehicle technology with the least amount of depreciation risk. Regardless of the reason, people who lease versus purchase spend less money out of pocket, have few (if any) vehicle-maintenance and -service expenses, and don't worry about the value of the car at the end of the contract. For vehicles driven 10,000 miles a year or fewer, leasing can make financial sense. Given a relatively high sticker price, adoption of vehicles with evolving technology may depend on leasing as an attractive alternative to purchase.

The MacroMonitor reports that 6 million households currently lease a vehicle; Generation Xers are somewhat more likely than average to do so. This cohort's Life Stage may well contribute to their lease-versus-purchase decision. With many cash-flow pressures, some GenXers are highly attuned to money savings—money saved by virtue of a lower monthly vehicle payment can provide a tidy sum to apply elsewhere.

Going forward, the leasing trend will depend largely on Millennials' adoption. As Millennials mature, will they retain their penchant for minimal ownership responsibilities? If so, the proportion of Millennials who lease vehicles should increase. Should Millennials' interest in hybrid vehicles, EVs, autonomous vehicles, and time-share vehicles be high and interest in ownership remain low, the two factors could intersect to produce a surge in leasing growth.

Increasingly, companies need not just a long view but also a broad view of what's likely around the corner. Strategic Business Insights (SBI) offers syndicated programs in financial services, technology commercialization, business-environment scanning, consumer psychology, and strategic-planning tools for the future. If your organization could benefit from SBI's unique combination of syndicated programs and strategic planning, please contact us.

Subscribers have access to this month's Segment Summary—Will Households That Currently Lease a Vehicle Lease an EV?—and may request the underlying set of data for this Segment Summary. To learn more about households that lease vehicles, contact CFD today.

Learn More about the Future of Vehicles from Other SBI Services

Scenario Planning

- Scenarios for the Future of Electric Vehicles