MacroMonitor Market Trends Newsletter July 2018

If you are not a MacroMonitor sponsor but would like more information about this topic, please contact us.

Money–Related Stress and Worry

Clients may access the July Segment Summary: Households Stressed or Worried about Money. A copy of the underlying data in an excel spreadsheet is available to MacroMonitor subscribers upon request.

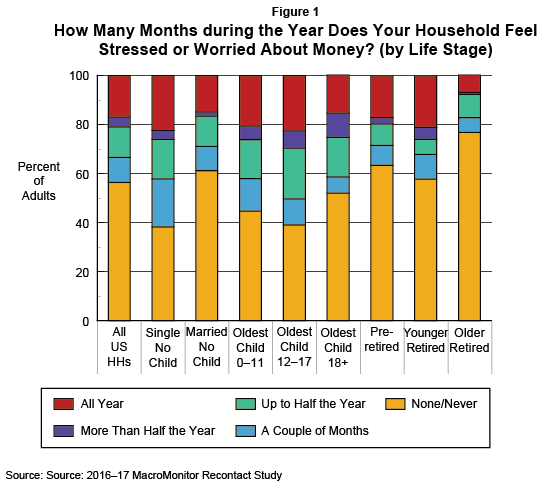

The Federal Reserve System's Report on the Economic Well-Being of U.S. Households in 2015 (the most recent report available) found that 54% of individuals could fairly easily handle an emergency expense of $400; 46% of individuals would need either to sell something or to borrow money to meet a $400 emergency. As a result of the report findings, one can easily imagine roughly the same proportions of households (HHs) would have, or would not have, worries about money. To understand money stress and worry better, the 2016–17 MacroMonitor Recontact Survey asks respondents about the duration of their concerns. As of summer 2017, the data reveal that almost 57% of US households say they have no money worries, or if they do have worries, they don't feel stressed about them.

We review of the number of months in which households are stressed and worried by life stage, in comparison with all US households. The results are somewhat predictable. For example, married HHs without children are less likely than HHs with children younger than age 18 to worry because, without children, most HHs have less pressure on their time and income. Mature, retired HHs are less likely than young, single households to worry because some mature HHs have amassed sufficient assets to live in retirement or have learned to live on the income and assets they have.

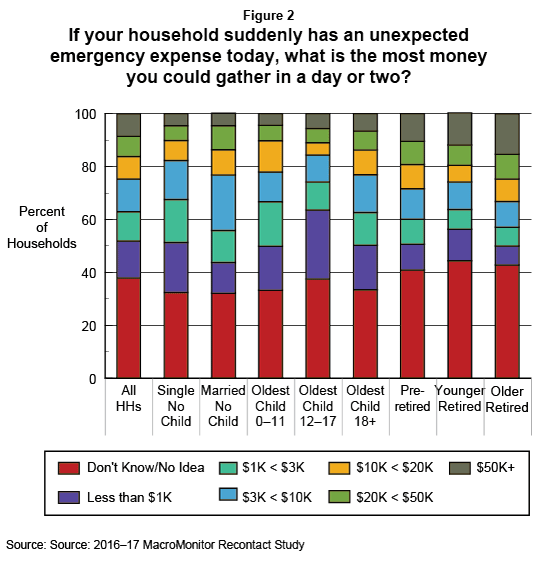

Another way to consider financial stress and worry is to measure how a household would handle an emergency expense on the basis of its magnitude. The recent Fed study asked respondents to assume a $400 fixed expense. By comparison, the 2017 MacroMonitor Recontact Survey asked respondents to report the largest magnitude of an unexpected expense that they could handle as a continuous variable. For example, in case of an emergency expense, mature, retired HHs are more likely than other HHs to be able to gather the most money within a day or two, averaging over $18,000 (including $0).

A look at the demographics, financials, and attitudes of households' financial stress and worry, both by the duration and magnitude of their concerns, is available through the MacroMonitor. Looking at both dimensions of time and money produces more insightful and actionable results for financial-services providers than do some traditional analyses of a fixed amount or the binary distinction of being stressed or worried or not. One area of opportunity may be surprising: Some households aren't worried about money but clearly should be, and others are worried but may not need to be. Understanding if the concern is based on reality or perception can facilitate financial providers' methods of providing assistance.

Subscribers have access to this month's Segment Summary—Households Stressed or Worried about Money—and may request the underlying set of data for this Segment Summary. To learn more about money-stressed households, contact CFD today.