MacroMonitor Market Trends Newsletter June 2018

If you are not a MacroMonitor sponsor but would like more information about this topic, please contact us.

A Growing Market: Investors Age 70 and Older

Clients may access this month's Segment Summary, Women Investors Age 70 and Older, and a copy of the underlying data in an excel spreadsheet is available upon request.

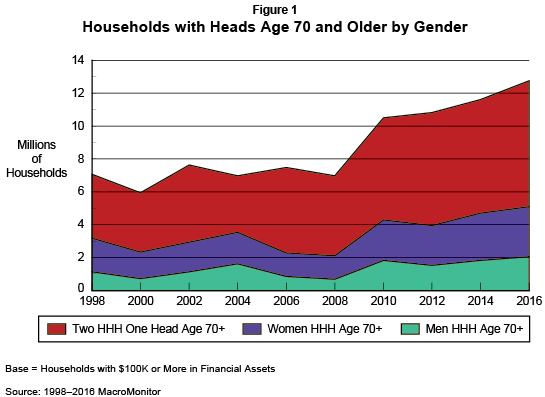

Since 2008, the number of households with a head age 70 or older has grown because of aging Baby Boomers and the longevity of household heads age 80 and older. Between 1998 and 2016, the number of households with a least one head age 70 or older—and with financial assets of $100K or more—has grown from 7 million to almost 13 million. The majority of these households are currently two-headed households.

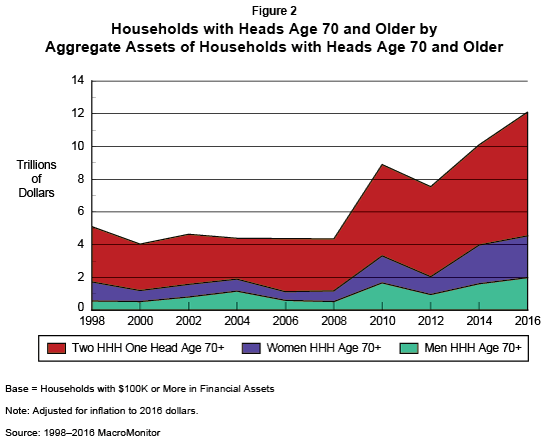

Many two-headed households have double the financial assets of single-headed households. The aggregate of financial assets held by households with at least one head older than the age of 70 has increased from $3.4 trillion in 1998 to $7.6 trillion in 2016. With more money than single-headed households have to save and invest and a long run of bull markets (except the global recession evident in the 2012 numbers), two-headed households have seen their financial assets increase at a much faster rate than those of men- or women-headed households.

The income disparity between men and women is offset by women's longevity; the number of single-women heads older than age 70 is about 1 million more than the number of men-headed households of the same age. Because women tend to outlive men, data projections suggest that 5.3 million women may change their use of financial professionals should they become widows. Potentially, up to $5.3 trillion could be in play. As households with heads now in their 60s enter their 70s, an additional 7.3 million accounts—and an additional $7 trillion in financial assets—will assure that the number of mature women-headed households and the assets they control will continue to increase.

Don't be blindsided! Many women investors now in their 60s and early 70s are not like the women of yesteryear.

Sponsors may request trends and profiles of any investor group age 70 and older at any time. June's Segment Summary PowerPoint deck: Women Investors Age 70 and Older profiles important mature women-headed households.

Contact CFD today to learn more.