MacroMonitor Market Trends Newsletter March 2018

If you are not a MacroMonitor sponsor but would like more information about this topic, please contact us.

FinTech and the MacroMonitor

The term FinTech is currently in use to describe a broad range of products and services, from back-office functions to cryptocurrencies. The term also applies to new technologies that enable the customer to interact (or self-serve) with their finances with fewer intermediaries than previously. The FinTech label may be new, but the idea of integrating new technologies into financial services enabling consumers to address their financial needs directly goes back decades.

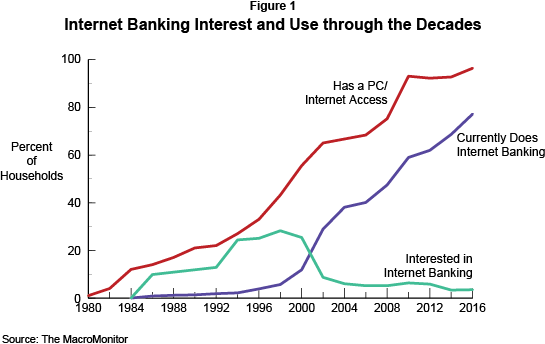

Basic lessons about product and service introduction and diffusion and adoption of new technologies follows a familiar pattern. As Figure 1 illustrates, in 1984 fewer than 1% of households took advantage of home banking. In order to be among this group, the potential household needed to have a home computer—such as a Commodore, an Amiga, a TRS 80, an IBM Peanut, an Apple Lisa I—and a telephone-coupler modem (300 baud!). The use of computers in the home increased during the 1980s into the 1990s, but not until the mid-1990s, with the introduction of the graphical user interface (GUI) and the explosion of the World Wide Web, did the incidence of home banking hit critical mass. From the late 1990s until today, the use of home banking has increased as fast as—if not faster than—the increasing proportion of households accessing the internet.

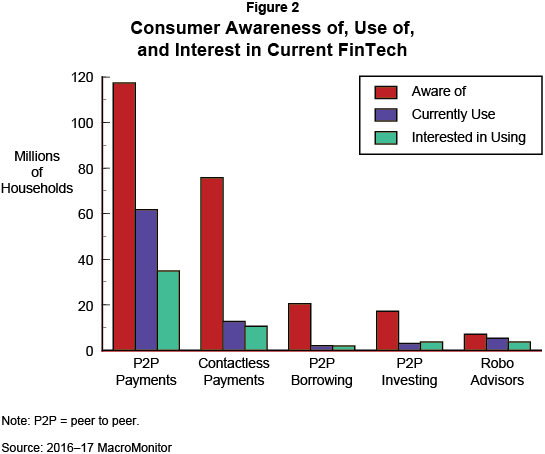

The rate of awareness of a new product or service always leads the rate of adoption (Figure 2). Initially, the proportion of households interested in trying what is new is greater than the number of households actually doing so but less than the number of households that have the capability to do so; the use of FinTech requires technology-enabled devices and internet access. This point is critical to the successful diffusion of any technology, product, or service. Unless an appeal and motivation exist for consumers—other than early adopters—a new technology can wither (remember Betamax, DIVX, and numerous others). However, the appropriate appeals, benefits, and targeted marketing to consumer segments most likely to follow early adopters can encourage consumer adoption (diffusion).

To help sponsors understand more about FinTech from the customers' point of view, the MacroMonitor tracks internet banking and investing and customer awareness of, use of, and interest in behaviors such as peer-to-peer payments, borrowing, or investing; contactless payments; and robo advisors. Measures of interest in and use of specific products and services online are also available for banking, credit, investing, and insurance, as well as whether the household uses a smart phone, tablet, or personal computer for these products and services. Sponsors may request trends and profiles of these populations at any time. However, for firms interested in predicting FinTech's adoption and diffusion potential, this month's Segment Summary explores households that say they are interested in using peer-to-peer payments and households interested in robo advisors.

Contact CFD today to learn more about households receptive to predicting FinTech's adoption and diffusion potential.

Related CFD Mini-Presentations

- 2016–17 MacroMonitor First Peek: Contactless Payments

- 2016–17 MacroMonitor First Peek: Peer-to-Peer Financial Services

- 2016–17 MacroMonitor First Peek: Robo Advisors

Learn More about FinTech from Other SBI Programs

Explorer

Scan™

- Blockchain Technology's Proliferating Uses

- Digital Transformation of the Financial-Services Industry