MacroMonitor Market Trends Newsletter November 2015

If you are not a MacroMonitor sponsor but would like more information about this topic, please contact us.

Millennials and Financial Services

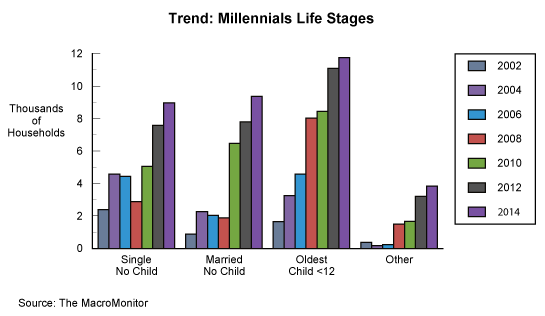

Millennials (adults between the ages of 18 and 34) are the largest age cohort in the United States today but only 25% of all US households. Coming of age during difficult economic times constrains the ability of many Millennials to form their own independent household. Because of their age diversity, Life Stage may be the most useful segmentation to explain Millennials' financial product and service use. The MacroMonitor reports 18.4 million Millennials households with no children; 11.8 million Millennials households with dependent children age 12 or younger. The prevalence of Millennials in early Life Stages suggests that many have the majority of their financial goals still ahead: career, home, and family.

In the next 10 to 15 years, Millennials' need for most financial products and services will be high—especially for credit and protection from income loss. To achieve their financial goals (such as a home purchase, funding children's educations, and successful retirement), they need to implement savings and investment strategies early; time is the most important resource Millennials' have to achieve their goals.

Marked differences exist within the Millennials cohort. Affluent Millennials are more satisfied with their household's financial situation than are Nonaffluent Millennials; they are more likely to have a financial plan. Even though they have fewer assets than all households do, Affluent Millennials feel confident they are on track to meet their goals.

A focus now on the next generation of customers is critical not just to beat the competition, but because Millennials are less trustful of financial providers and intermediaries than all households are—winning them over will take awhile. Millennials households with incomes between $50K and $100K (32% of all Millennials households) and 38% of Nonaffluent Millennials households are viable targets for financial-services providers, because these households have the cash flow to save and invest; as they mature, their needs and assets will grow.

To learn more about Millennials households' financial products, services, and needs and their interactions and trade-offs, please contact CFD.

If this market segment is important to the future of your business:

From their CFD client-landing page, MacroMonitor subscribers may:

- Access the November 2015 Segment Summary, Millennials: Poised to Mature.

- View the November 2015 Quick Stats, Trend: Millennials Life Stages.

- Schedule a full presentation about these households, including a customized and proprietary Q&A session. Contact Us to schedule your presentation.