MacroMonitor Market Trends Newsletter February 2014

The MacroMonitor Market Trends Newsletter from Consumer Financial Decisions (CFD) highlights topical news and trends of interest to you and your colleagues.

What Happened to Retail Mutual Funds?

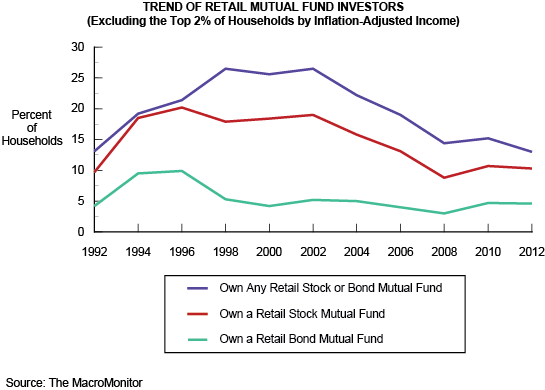

The modern mutual fund was invented in 1924, went public in 1928, and gained widespread use in the 1980s. By the 1990s, retail mutual fund investing had expanded into the mass market. Between the post-1991 recession and 2000, the number of households that were retail mutual fund investor–households had doubled from 13% in 1992 to 26% in 2000. In 2008, however, the incidence of retail mutual fund–investor households fell below 15%. Since the financial crisis of 2008, the proportion has declined back to 13%, despite the fact that stock markets have reached record highs. What happened to the retail mutual fund investor? Why did a product specifically to pool resources, minimize risk, and make investing safe and easy lose favor with the very segment it was designed to help?

Maybe the change has nothing to do with the product or the way it sells, but with how 98% of households feel about investing in general. Mutual fund providers face very real challenges: intense competition, new and different product offers, more diligent regulators, and inscrutable markets. Today a mutual fund provider—whether manufacturer or distributor—faces investors who are skeptical and negative and who believe they have been ignored (at best) or misled. These factors affect all mutual fund providers, regardless of whether the provider markets directly to consumers or through intermediaries.

To resolve these challenges, the first step is to understand the 98% of below-the-top households, some of which might become retail mutual fund investors; excluded are the top 2% of households that have the resources to buy all types of investments. Because 98% of households have limited resources, they have to make decisions about financial goals and balance immediate needs with long-term objectives. The February 2014 Segment Summary explores current retail mutual fund investors (excluding the top 2%) as well as those who have recently purchased or indicate that they are likely to purchase a mutual fund in the next year. How to find and encourage more of these mutual fund investors and potential investors is the challenge facing today's mutual fund providers.

If this market segment is important to your business:

MacroMonitor subscribers may request a package of custom, edited data tables and charts that profile recent and likely investor households.

In addition, from their CFD client-landing page, subscribers may:

- Access the February 2014 Segment Summary, Retail Stock and Bond Mutual Fund Investors.

- Schedule a full presentation about these households, including a customized and proprietary Q&A session. Contact us to schedule your presentation.

If you are not a MacroMonitor subscriber but would like more information about retail stock and bond mutual fund investors, please contact us for package information and pricing.