MacroMonitor Market Trends Newsletter January 2014

The MacroMonitor Market Trends Newsletter from Consumer Financial Decisions (CFD) highlights topical news and trends of interest to you and your colleagues.

When Will Investors Return?

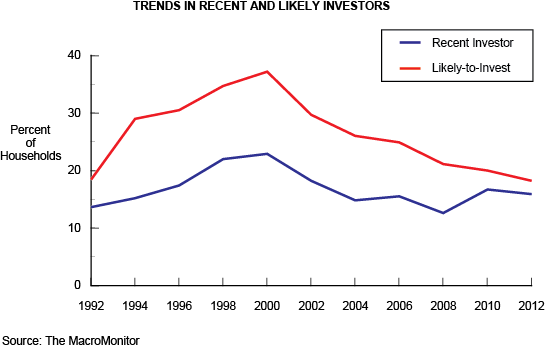

During the 1980s investment products such as 401(k), 403(b), and 457 retirement plans and mutual funds appeared, found acceptance, and gained widespread use. In the 1990s, households became active in retail investing. Between the post-1991 recession and the end of the decade, the number of households that were recent-investor households—households that bought at least one retail stock, mutual fund, or ETF in the past two years—nearly doubled from 14% in 1992 (14 million households) to 24% in 2000 (26.3 million households). However, in 2008, the proportion of recent-investor households dipped below the 1992 level to 13%. Since then, the proportion of recent-investor households has inched up to 16% (20.7 million households) despite the fact that the market has reached record highs. The question is, "When (if at all) will households return to 2000 retail investing levels?"

The answer is, "Not until the proportion of households with interest in retail investing grows." The proportion of households that say they are somewhat or very likely to buy a retail stock, mutual fund, or ETF in the next 12 months is always higher than the proportion of households that actually invested in the past two years. However, in the past two decades, the trend in the gap between households likely to invest and households that have invested has narrowed significantly. At its peak in 2000, 37% of all households were likely to invest in the coming year—twice as many as in 1992 (18%) or in 2012 (17%). The trend of likely investors has declined consistently since 2000. In 2012, the proportion of households likely to invest in the coming year is only somewhat higher than the proportion of households that have made a retail investment in the past two years. Before retail investing will improve, the proportion of households likely to make an investment in the next 12 months must increase significantly—at minimum, a 3% increase.

Insights about why fewer households are investing derive from a comparison between 2000–01 MacroMonitor data and 2012–13 MacroMonitor data. When will the Mass Affluent return to the markets? Will younger households mature, amass assets, and become investors, or has the marketplace changed? This month's Segment Summary compares recent and likely investors in 2000 with those in 2012.

If this market segment is important to your business:

MacroMonitor subscribers may request a package of custom, edited data tables and charts that profile recent and likely investor households.

In addition, from their CFD client-landing page, subscribers may:

- Access the January 2014 Segment Summary, Recent and Likely Investor Households.

- Download the January 2014 Dirty Dozen—a dozen annotated graphic-analysis slides that pertain to recent and likely investor households.

- View Quick Stats for a chart of recent and likely investor households from 1992 through 2012.

- Schedule a full presentation about these households, including a customized and proprietary Q&A session. Contact us to schedule your presentation.

If you are not a MacroMonitor subscriber but would like more information about recent and likely investor households, please contact us for package information and pricing.