MacroMonitor Market Trends March 2013

MacroMonitor Market Trends is a newsletter from Consumer Financial Decisions (CFD) that highlights topical news and trends of interest to you and your colleagues. If you would like more information about the topic in the newsletter or would like to discuss other ways that we can assist you in your research or marketing efforts, please contact us.

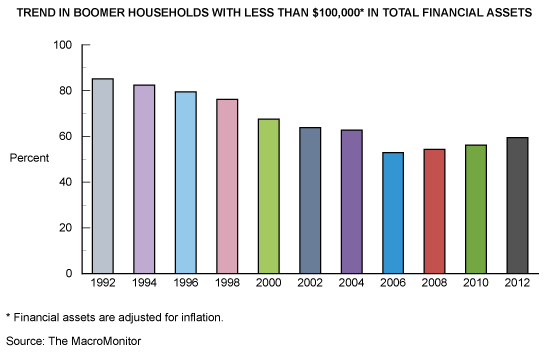

Retirement Is Not an Option

Three out of five Boomer households have less than $100,000 in total financial assets. These 26 million households—headed by adults between the ages of 50 and 66—have no choice but to continue working, because the time remaining to them before retirement is insufficient to amass enough assets to retire. For the past decade, when Boomers needed to save money in a sprint to retirement, the majority have seen their financial assets decline or remain below an inflation-adjusted $100,000 threshold. The bottom line is that more Boomers today have less in financial assets (excluding home equity) than was the case a decade ago.

Many financial advisors suggest a household should have $500,000 to $1,000,000 in financial assets before considering retirement. Academic researchers have reported that an average couple now age 65 will require nearly a quarter of a million dollars for out-of-pocket health care before they die. Some 6 million Boomers with financial assets of $100,000 or less are fortunate enough to have a pension, but recently, even these contracted guarantees are in jeopardy. Boomers who delayed having children until they were in their forties and beyond (3 million) continue to have responsibilities for dependent children. In addition, some 2 million Boomers have boomerang kids in the home and children older than age 18 who still depend on their parents for rent and other financial support. Further, 5 million Boomers are financially responsible for other adults such as parents, siblings, and adult children. Such current and ongoing responsibilities overwhelm these households' ability to save or save more. Consequently, these households must put aside thoughts of retirement—perhaps permanently.

Financial institutions tend to focus their products and services on the affluent, competing most aggressively for the top 2%. Boomers and the remaining Silent and Greatest generations control over two-thirds of all the wealth in the United States today. However, this wealth is not evenly distributed. The vast majority of this wealth is concentrated in the top 2% of households and much of the rest in the next 18%. Most of the age cohorts older than Boomers are already retired with established finances. The majority of Boomers—those not in the top 20%—face a very different future. One of the most dangerous consequences of the hollowing out of the middle class in the past several decades is that for well more than half of all Boomers, retirement is absolutely not an option.

MacroMonitor sponsors may access insights about Boomers with less than $100,000 in financial assets in the March 2013 Segment Summary, available from your company's SBI/CFD landing page. Sponsors may request a full presentation, including a customized and proprietary Q&A session. Sponsors may always request Segment Summaries about other populations of particular interest to your organization. To learn more about Boomers with less than $100,000 in financial assets, please contact CFD.