Why-ology News: Trend Go beyond the what to the why of consumer behavior. April 2018

Paying by Check

It is increasingly rare for banks to return checks that clear the bank to the person who wrote them, and increasingly common for banks to charge customers for paper statements. In fact, in 2016, Valarie Rind of GOBankingRates (a personal-finance resource owned by ConsumerTrack) forecast that in ten years, banks will no longer offer checks and paper statements. Several decades have passed since technology promised a transformation to a "paperless" society. However, as is true of many prophecies, reality is more of an extended evolution than a transformation.

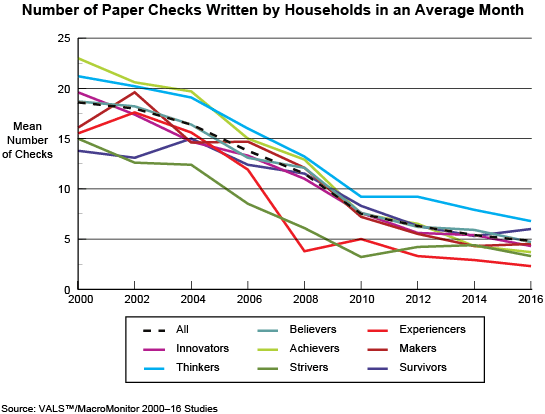

Data trends, not single-point-in-time data, clarify how the marketplace is evolving—both the rate and the pace of change. To learn about the use of (paper) checks, a 16-year trend using VALS™/MacroMonitor data follows.

Between 2000 and 2016, the proportion of households with a checking account remains unchanged at 90%. During the same period, the mean number of checks written in an average month by all households has declined from 19 checks per month to 5 checks per month. In 2016, Believers are more likely than other consumer groups to write checks (7); Experiencers are the least likely to write checks (2).

VALS/MRI data from spring 2017 provides additional detail about how each VALS group is paying bills. Almost half of US adults pay bills online; Innovators, Achievers, and Thinkers (in rank order) are more likely than all adults to do so. Innovators are also more likely than all adults to have automatic deductions from their banking account, to have charging of bills to a credit card, and to pay bills by mobile device. Innovators have options, and they want flexibility. Achievers are more likely than all adults to use automatic deductions, to pay online, and to pay by mobile device but not to charge a credit card. Even though Achievers may want the ability to gain "rewards" points to help extend their buying power, for example, many struggle with above-average debt. Thinkers are more likely than all consumers to pay bills by credit card but not to pay online or by mobile device. Thinkers consider themselves to be smart shoppers; because the majority have below-average credit-card debt and the ability to pay credit-card balances in full each month, Thinkers are in a position to receive credit-card perks such as rewards points or travel miles.

If your organization conducts proprietary research (or plans to do so), contact us to inquire about including VALS in your survey so that you can leverage your research investment by linking your data with existing VALS-survey findings.

Visit the Why-ology Library and VALS homepage for more articles. Now featured: