Digital Transformation of the Financial-Services Industry Featured Signal of Change: SoC943 May 2017

Digital technology has transformed public and private life. In an August 2011 article, Marc Andreessen, cofounder of Netscape (AOL; New York, New York) and venture-capital firm Andreessen Horowitz (Menlo Park, California), argued that many industries are increasingly dominated by software and software companies. Andreessen pointed to developments in retail, music publishing, direct marketing, and recruiting as examples of how software can change industries. Andreessen also highlighted that "the financial services industry has been visibly transformed by software over the last 30 years" ("Why Software Is Eating The World," Wall Street Journal, 20 August 2011; online). But the true digital transformation of the financial-services industry might still lie in the future. Prominent mentions of FinTech—a term that refers to emerging technologies that see use in financial services and have the potential to upend the industry—by the media during the past few years attest to digital technology's potential to alter the financial-services industry.

Three developments in technology will have an impact on the financial-services industry: artificial intelligence, blockchains, and digital currencies.

In 2016, SoC851 — The Proliferation of Financial Technology looked at the potential of new technologies to affect the financial-services industry, and SoC856 — Looking at Opportunities in FinTech examined how incumbents can leverage such technologies to fight off start-up companies. This Signal of Change looks at three particularly relevant developments in technology that will have a substantial impact on financial applications and the financial-services industry as a whole: artificial intelligence (AI), blockchains, and digital currencies.

Because of its ability to learn from massive amounts of data, AI is finding use across industries. As data feed into AI systems, the technology can improve on existing applications and develop completely new ways to affect the global finance sector. AI has already affected many industries and will likely have a substantial impact on the banking and insurance industries in the next decade. According to CB Insights (New York, New York), venture-capital firms poured $5 billion into more than 650 AI start-ups in 2016—a 61% increase over such investments in 2015. In 2016, primarily large tech companies bought some 40 AI-technology start-ups. Major companies such as Amazon.com (Seattle, Washington), Baidu (Beijing, China), Facebook (Menlo Park, California), Google (Alphabet; Mountain View, California), IBM (Armonk, New York), and Microsoft (Redmond, Washington) are pursuing their own major AI-technology efforts, and the capabilities of AI have expanded significantly. For example, P0922 — AI Is Game highlights how AI's growing proficiency at playing complex games is indicative of AI's potential to solve complex problems in business and government. Artificial intelligence generally refers to software applications that can perform tasks that people commonly believe require human intelligence. Big data is synergistic with AI because many machine-learning approaches—especially deep learning—rely on large data sets (see SoC899 — In Deep Learning, Quantity Matters for discussions about how organizations are quickly amassing and using large data sets to implement deep-learning systems effectively). AI already has made inroads in the financial-services industry. For example, P0926 — Smart AI in Investing outlines the ways that a new breed of investment companies and technology providers are leveraging AI to manage investment funds.

Blockchains—distributed databases, or shared digital ledgers, that are highly resistant to tampering—gained notoriety as the technology behind the Bitcoin (http://bitcoin.org) cryptocurrency; however, a wide range of applications could ride on blockchain technologies. An August 2016 report by the World Economic Forum (Cologny, Switzerland) and Deloitte Touche Tohmatsu (New York, New York) estimated that more than 24 countries are investing in blockchain technology and that organizations had filed more than 2,500 patents relating to and invested more than $1.4 billion in blockchain technology in the past three years. Blockchain technology could create a trustworthy system in environments that lack trust between transaction partners—particularly online environments that often prevent a person from even knowing the individual or organization he or she is engaging with. Marc Andreessen believes that Bitcoin, and the underlying blockchain-based approach, could provide a practical solution to the problem of establishing "trust between otherwise unrelated parties over an untrusted network like the Internet" ("Why Bitcoin Matters," Bits [blog], New York Times, 21 January 2014; online). Because blockchains permit all users to inspect the records they contain but distribute control of these records across a network so that no individual can control the information, they enable secure record keeping that users can trust and rely on. Decentralized cryptocurrencies such as Bitcoin publish blockchains openly, thereby establishing transparency. But various methods such as using encryption technologies could nevertheless preserve the privacy and banking secrecy of blockchain-related transactions, providing detailed information to authorized users only. Blockchain applications could contain ownership and ownership-transfer information, find use for escrow purposes, and even enable secure transfer of key codes and access information.

Finally, digital currencies, which rely on blockchain technology, could transform many financial transactions in the near future. Prominent digital currencies—including Bitcoin, Ether (Ethereum Foundation; Baar, Switzerland), and Ripple (Ripple; San Francisco, California)—enable users to store and transfer monetary value via blockchain application. Scaling digital currencies' underlying blockchain-based approach—specifically, how to scale that approach for sovereign digital currencies to enable those currencies to compete on the same scale as that of traditional sovereign currencies—is a concern for potential digital-currency users. The potential impact of government digital-currency use could be substantial. For instance, Bank of England (London, England) economists John Barrdear and Michael Kumhof wrote a research paper in which they argue that central banks should issue their own kind of blockchain-powered digital currency to gain complete control over the amount of money in an economy. The economists estimate that their approach could provide the US economy with a permanent boost of about 3% and give policy makers new and effective mechanisms to smooth economic cycles.

Digital technology has transformed virtually every industry, including the financial-services industry. Similar to how manufacturing industries might experience substantial changes when exploiting the emerging Internet of Things, the financial-services industry could experience drastic transformation as it leverages AI, blockchain technology, and digital currencies in coming years.

The Development of this Signal of Change

Data Points

- In 2016, primarily large tech companies bought some 40 AI-technology start-ups.

- Blockchain technology could create a trustworthy system in environments that lack trust between transaction partners.

- Digital currencies, which rely on blockchain technology, could transform many financial transactions in the near future.

Implications

Digital Transformation of the Financial-Services Industry

The true digital transformation of the financial-services industry might still lie in the future.

Previous Alerts

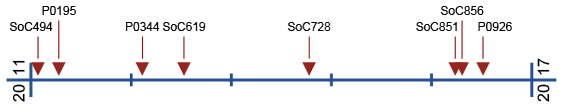

- SoC494 — The Advent of Mobile Banking (February 2011)

Advances in both smartphone technology and mobile-banking services paired with increasingly widespread ownership and use of mobile phones set the stage for adoption and rapid diffusion of mobile digital-banking applications. - P0195 — Payment Battles (May 2011)

A battle is brewing for dominance of next-generation electronic-payment systems. - P0344 — Citizen Empowerment in Financial Transactions (May 2012)

Shifting global consumer attitudes and emerging technological applications may prime the financial world for a structural revolution. - SoC619 — Rise of Digital Wallets (November 2012)

Digital wallets have the potential to replace physical wallets entirely and introduce a new set of players into the financial market. - SoC728 — Cryptocurrencies' Potential (May 2014)

This Signal of Change explores differences between various cryptocurrencies and application potential. - SoC851 — The Proliferation of Financial Technology (February 2016)

The process of FinTech's affecting the traditional financial industry has already begun, and many reasons for why the global financial-services industry is vulnerable to disruption exist. - SoC856 — Looking at Opportunities in FinTech (March 2016)

Incumbents in the financial industry will not give up territory and business without a fight. - P0926 — Smart AI in Investing (June 2016)

A new breed of investment companies and technology providers are leveraging artificial intelligence (AI) to manage investment funds.