Trends Newsletter July 2022

If you would like more information about this topic, please contact us.

Shrinkflation

Nothing is shrinking faster than the purchasing power of the dollar. Inflation and shrinkflation are closely related. Manufacturers know that consumers are less likely to notice shrinking product sizes (less cereal in a box or fewer sheets of bathroom tissue on a roll) than price increases. There are a myriad of reasons being 'sold' as the cause of getting less (product) for more (money): supply-chain and transportation problems, raw-material availability, climate change, worker shortages and increasing wages. Poor inventory control and inadequate forecasting are rarely mentioned as causes. Exorbitant CEO pay, rising shareholder dividends, and stock buybacks are rarely cited factors.

On 10 June 2022, the US Department of Labor announced that inflation reached a 40-year high surging 8.6% in May "from 12 months earlier, faster than April's year-over-year increase of 8.3%;" the fastest growing 12-month increase since 1981. S&P Global predicts the pace "will likely continue through September." Raising interest rates to curb inflation will hurt many households. Credit use is already headed upward; many people struggle to recalibrate expenses and reallocate finances. An early June CivicScience survey finds that, 27% of individuals can't afford to see their doctor and 22% can't afford to buy their meds.

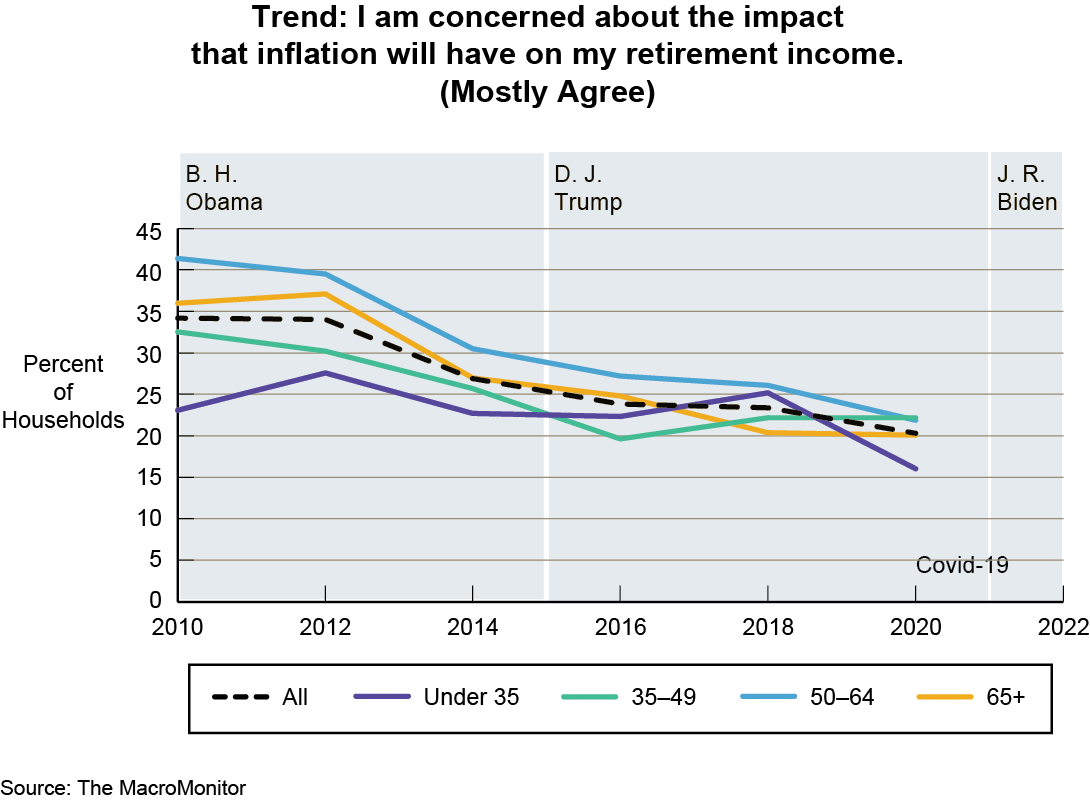

Inflation is particularly disruptive for fixed-income households (HHs) and Baby Boomers. The 69 million people on social security who received a "5.9% COLA (cost of living adjustment) increase in January 2022—the biggest jump since 1982"—are caught woefully short. Many Baby Boomers, hoping to retire in the next five years, will need to delay their plans to save and invest for retirement longer than anticipated. Over the past forty years, the threat of inflation has abated and the country has been lulled into complacency. By 2020, only 34% of HHs mostly agree they are concerned about the impact of inflation on their retirement income. With a potential bear market looming, confidence in investment performance is eroding.

Thirty percent of all US HHs report their number one goal is saving for retirement. Successful retirement is closely tied to a HHs' savings and investments. More than half of Concerned HHs are worried about having adequate income during retirement with the same proportion worried about outliving their savings and investments. Among all Concerned HHs, 32% have 50- to 64-year old heads and 25% have heads between the ages of 35 and 49. Mean balances in retirement products for mostly Concerned HHs ($232K) lag behind that for all US HHs ($308K). For example, among 50 to 64 year old heads—only 7% have one million dollars or more in retirement products—slightly less than half the incidence of all US HHs (14%). Of Concerned heads between the ages of 35 and 49, only 7% have a half a million dollars or more in retirement products. Even for Concerned HHs with high balances, a million dollars doesn't go as far as it used to. Inflation presents a double whammy for soon-to-retire HHs because the ability to save and invest may diminish while the amount of what the money will buy also diminishes.

Demographically, Concerned HHs have higher proportions of singe-headed and women-headed households than are present among all HHs; these HHs are stressed across a wide range of issues. Life events drive much of their stress. In the past two years, instances of a major illness, job loss, or an income decrease of more than 25% are higher than average for all HHs.

Consumer Sentiment is trending down. "The University of Michigan's closely watched Surveys of Consumers slumped to 50.2 in June marking the lowest level ever recorded; the university first began to collect data in 1952. The thirteenth of June, the "S&P 500 opened in bear-market territory... amid a broad sell-off across markets." Cryptocurrencies have cratered. On June 15th, the Fed announced a three-quarter of a percent increase in the interest rate; the largest since 1994. "In a Financial Times poll, nearly 70% of economists said they expect the US to tumble into a recession as the Fed moves to combat inflation. Respondents largely expect the downturn to be officially declared in the first half of 2023."

As food, vehicles and brown-goods prices continue to soar, gas prices remain high, and home prices remain out of reach for the majority, this summer's 2022 MacroMonitor survey offers the opportunity to measure how many HHs are concerned, and to what extent HHs will alter their savings, investment, and retirement plans as a result. Inflation affects all HHs. What are the implications for your organization? What can you do to help your customers?

"The longer you can look back, the further you can look forward."

— Winston Churchill

The MacroMonitor has more than four decades of data about US Households that include data from the 1980—83 Recession.

Contact us to set up a time to call, Zoom, or WebEx.