Trends Newsletter May 2021

If you would like more information about this topic, please contact us.

Let's Talk About Children

If the $20 billion consumers spent in May 2020 on Mother's Day gifts had been spent on infrastructure to support households (HHs) with kids, the United States might not be facing a she-cession. Today, infrastructure is a gender issue. The loss of 2.2 million women in the workforce due to the pandemic has far-reaching economic repercussions—the estimated $2 trillion loss is felt at the cash register because women are responsible for 80% of consumer spending; in financial services, because women are increasingly responsible for household financial decisions about savings and investing.

Child-care responsibilities contribute to workplace pay inequity and fewer promotions. When faced with a choice of which parent should stay home as caregiver, women lose because (in the majority of cases) women earn less than men. Mothers of small children have lost work at three times the rate of fathers in the past year. Women have reached the breaking point for being the country's safety net. For economic reasons and inequality issues, President Biden's proposed American Families Plan provides critically needed financial support for childcare services and education.

Fewer women than previously choose motherhood and birth rates for teens are at a low not seen since 1946. The Center for Disease Control (CDC) reports that since 2007, the US birth rate is lower than needed to replace the previous generation. This downward trend is unlikely to reverse. Women with high levels of education choose fewer pregnancies, or none at all; a growing number of women elect to remain single; more women than previously choose to have no children because of economic instability, career disruption, or both.

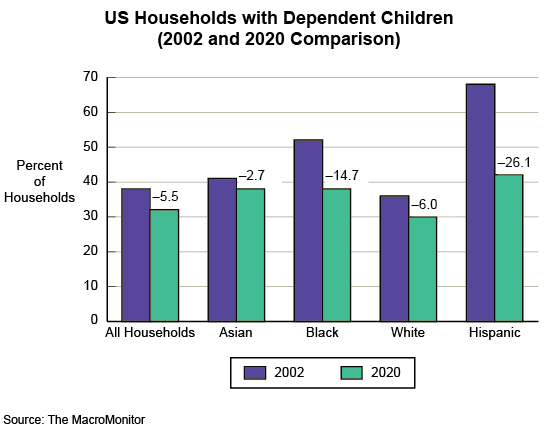

The proportion of US households with dependent children has declined since 2002; the decline is highest among some ethnic households. Coincidentally, women in ethnic groups suffer from the greatest pay inequality and have experienced the greatest number of pandemic-job losses.

Between 2002 and 2020, the percent of HHs with children has decreased by 5.5 percentage points from 37.5% to 32%. During the same period, the percent of HHs with children under age 6 has decreased by 2.2 percentage points. Declines are sharpest among Black HHs (a decrease of roughly 10 points) and Hispanic HHs (a decrease of more than 17 points). There are declines for each subsequent age group of children. For example, for HHs with children between the ages of 6 and 11, there is a decrease of 6 percentage points for Black HHs and a 17-point decrease for Hispanic HHs. Corresponding differences for HHs with children between the ages of 12 and 17 are 3.5 and 16.3 percentage points. Declines in children in Asian HHs are smallest in all age groups. Women's choices and immigration policies are factors in these declines.

The past two decades have taught us that:

- Very little (if anything) happens in isolation, and

- Very little is unrelated to the financial status of a household.

Because the MacroMonitor covers all financial sectors, we're able to mine the data to prove, disprove, or confirm a hypothesis, quantify the size or importance of answers, uncover new and surprising facts. Such is the case regarding families: We expected a story to emerge about family size: instead we found an important story about families by ethnicity. Because of the interconnected nature of the topic, to do it justice is beyond the scope of our newsletter, but not beyond the scale of possible analysis enabled by the use of single-source data.

Additional deliverables are available to MacroMonitor subscribers:

- The May 2021 Stories: Households with Young Children

- The underlying set of data for the May Stories (by request)

For more information, or to have a conversation, give us a call or shoot us an email to setup a time for a discussion. We're easy to reach.