MacroMonitor Market Trends Newsletter June 2019

If you are not a MacroMonitor sponsor but would like more information about this topic, please contact us.

Widowed Households

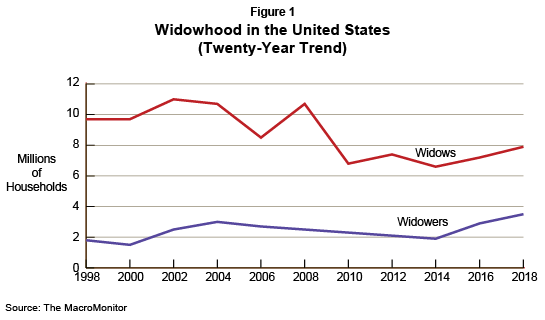

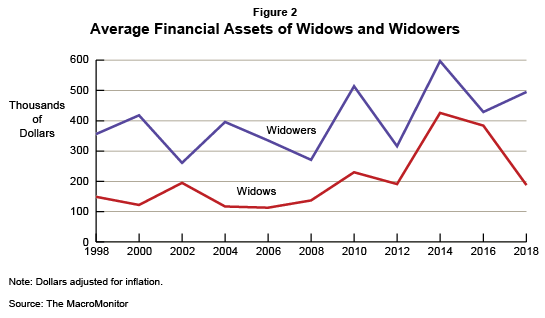

The 2018–19 MacroMonitor data contain 11.4 million widowed households. With an average of $283,000 in financial assets per widowed household, this group controls $3.2 trillion in aggregate. Historically, widows (69%) have always outnumbered widowers (31%). As the Baby Boomers enter their seventies, the incidence of widowhood will continue to increase (note the uptrend since 2014, when the first of the Boomers hit age 70), and with that increase will come a shifting of a significant amount of assets.

Often the death of a spouse drives the surviving spouse into responsibilities that may be new to him or her. This change is especially true for widows. Anecdotal evidence suggests that up to 70% of widows change their financial advisor when their spouse dies, signaling an opportunity for financial advisors to obtain new clients.

The average (inflation-adjusted) amount of financial assets held by widows and widowers in the past 20 years is in Figure 2. Individually, widowers have more money than widows have when their spouses die. However, historically, widows have more aggregate wealth.

Most widowed households are now, or will soon be, facing required minimum distributions from their retirement funds. As they age and face diminishing assets, mental acuity, or physical health, some widowed households will need professional financial advice more than ever. A good advisor will ensure that clients have established beneficiaries, powers of attorney, regular and living wills, and instructions to cover potential contingencies of incapacity. Effectively helping widows establish, review, and modify these financial-hygiene factors may also increase trust for financial institutions among their heirs, ushering in a new generation of potential advisory clients and increasing the likelihood of retaining the assets under management for the surviving spouse and beyond.

The MacroMonitor provides comprehensive information to identify, profile, and understand widows' needs and insights into how to meet these needs. For more information, please contact us.

Subscribers have access to this month's Segment Summary: Widow Households, which highlights their financial attitudes, behavior and balance sheet metrics. Subscribers may also receive the underlying set of data for this Segment Summary upon request. For more information, contact CFD today.