MacroMonitor Market Trends Newsletter March 2019

If you are not a MacroMonitor sponsor but would like more information about this topic, please contact us.

Do-It-Yourself Financial Planners

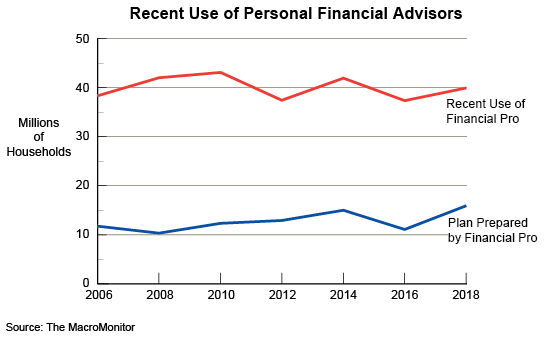

An old saying holds that "A lawyer who represents himself has a fool for a client." For financial planning and advice, many investors these days are doing it themselves, which means using online tools to write their own financial plans. In 2018, in addition to asking about written financial plans prepared by financial professionals, the MacroMonitor began to ask about plans prepared by the financial decision maker, including the use of online tools. Adding the 9 million self-prepared plans to the 16 million plans prepared by a financial professional, the total number of US households with written financial plans increases to over 25 million.

Even excluding the self-prepared plans, the number of households obtaining a written financial plan through the use of a financial professional has increased significantly to nearly 16 million. The vast majority of these written plans (72%) were prepared by professionals who are subject to a fiduciary standard.

In comparison with households that had plans prepared by a financial professional, households that created their own written financial plan are very different demographically, financially, and psychologically. They tend to be younger yet have higher annual incomes. They are more likely to have dependent children (especially younger than age six years) and are less likely to be widowed. Households writing their own plans tend to live in cities, and households with professionally written plans live in suburbs. The average values that both have in savings, liquid assets, total assets, home equity, and net worth are basically the same; households with professionally written plans average more in investable assets. The self-produced-plan households are more likely than households with professionally written plans to:

- Feel qualified to make their own investment decisions

- Feel comfortable doing financial business online

- Always look for the lowest-cost financial service.

Households with professionally written plans are more likely to:

- Recommend their financial advisor to a friend or colleague

- Follow their advisor to a new institution if they were to move

- Believe it is important that a financial-services representative keep them informed about where they stand financially.

The MacroMonitor provides fact-based information to identify, profile, and understand household populations better. For more information about households with professionally prepared and self-prepared financial plans, please contact us.

Subscribers have access to this month's Segment Summary: Households That Self-Prepared Their Financial Plan—an analysis of these investor households, and an opportunity for financial services companies. Subscribers may request the underlying set of data for this Segment Summary. For more information, contact CFD today.