MacroMonitor Market Trends Newsletter December 2018

If you are not a MacroMonitor sponsor but would like more information about this topic, please contact us.

Caregivers

During this season of giving, we pause to recognize the people who give throughout the year: caregivers. In households that support dependent adults, a single person is most often the designated caregiver. A 2015 study sponsored by the National Alliance for Caregiving and the AARP Public Policy Institute—Caregiving in the U.S.—reports six in ten actual caregivers are women; most are married or living with a partner.

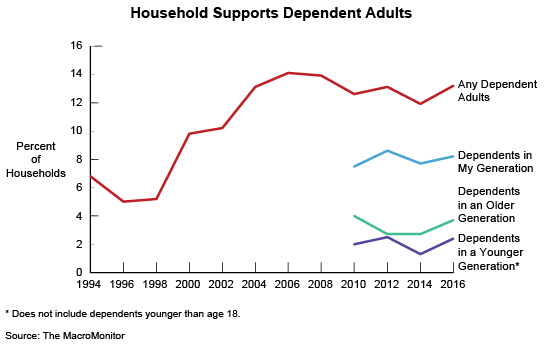

To determine which households are most likely to provide care (financial, physical, or both), the MacroMonitor measures households with dependent adults. Between 1994 and 2016, the percent of households with dependents has almost doubled, from 6.8% to 13.2%. Contributing to the increase in numbers of dependents are aging Baby Boomers, Boomerang Kids, and the increase in the US population of Asian- and Hispanic-headed households.

The 2016–17 MacroMonitor reports that 18 million US households support dependent adults; the majority of those households (11 million) support an adult of their own generation, and 5 million support an adult in an older generation; 21% of caregiver households care for adults in more than one generation.

Caregiving in the U.S. concludes, "Caregivers may need differing support depending on their loved one's condition and needs, and their own problems, strengths, and resources." Particularly vulnerable groups of caregivers are those who provide high-hour care (21 hours or more of care each week); many people in this group are older caregivers and caregivers who had no choice in assuming a caregiver role.

Households with dependent adults present several opportunities for financial-services organizations, because caregiver tasks frequently include the often-difficult task of managing fixed-income finances for their household as well as the finances of the recipient. In addition, Caregiving in the U.S. reports that high-burden caregivers (38%) and caregivers living with their loved one (40%) lack end-of-life plans and legal documents. The MacroMonitor finds that households with dependents are more likely than all households to want information about how to write a will, how to budget better, and how to manage debt—all areas in which financial providers can assist and for which additional products and services may be important.

The MacroMonitor provides fact-based information to identify, profile, and understand household populations better. For more information, please contact us.

Subscribers have access to this month's Segment Summary, Households with Dependent Adults, an analysis of households most likely in a position to be caregivers. Subscribers may request the underlying set of data for this Segment Summary. For more information, contact CFD today.