MacroMonitor Market Trends Newsletter May 2018

If you are not a MacroMonitor sponsor but would like more information about this topic, please contact us.

The Gig Economy

Clients may access this month's Segment Summary, Gig-Economy Workers, and a copy of the underlying data in an excel spreadsheet is available upon request.

A gig economy is a labor market characterized by the prevalence of short-term contracts or freelance work as opposed to permanent jobs; temporary positions are common, and organizations contract with independent workers for short-term engagements.

Once an unwritten, implied "social contract" existed between employers and employees. Employers would provide their employees with a living wage, sufficient to raise their families in a middle-class lifestyle, and employees would provide the labor that built the products and services that gave employers profits. The employers also provided benefits to the employee that facilitated and protected the employee's lifestyle, including a pension for when the employee would retire. And then, during the 1980s, significant changes occurred. The first was the huge increase in the participation of women in the workforce as a means for sustaining a middle-class lifestyle. At about the same time, a concerted effort developed to eliminate or reduce the influence of unions. The most recent iteration of this phenomenon is the Gig Economy.

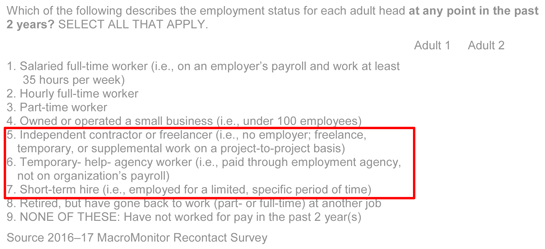

The 2016–17 MacroMonitor Recontact Survey—fielded in January 2018—included questions below to identify households in which a household head was a Gig-Economy worker.

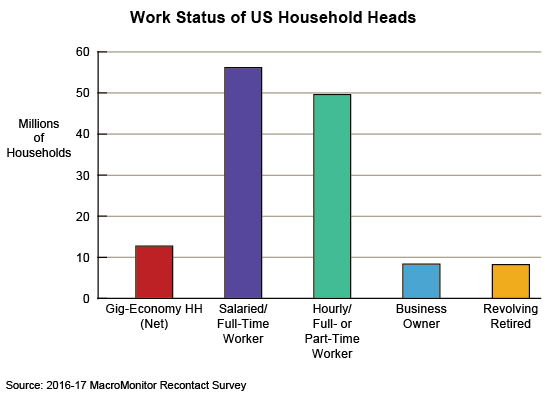

Respondents answering in the affirmative to items 5, 6, and 7 are Gig-Economy Households. Over 12.6 million US economic households have at least one household head who is a Gig-Economy worker. Over 9 million of these households are independent contractors or freelancers; over 3 million are short-term hires; 1.5 million are temporary workers. Results add to more than 12.6 million because more than one head may be a Gig-Economy worker or may also be a part-time worker, for example. By comparison, over 55 million households have at least one household head who is a salaried full-time worker; somewhat fewer than 50 million have a head of household who is an hourly (full- or part-time) worker. Over 52 million household heads have not worked in the past two years—these heads include people who are retired, disabled, and chronically unemployed.

The importance of better understanding people who are participating in the Gig Economy comes from the widely held belief that this part of the economy is growing. As services such as Uber, Airbnb, TaskRabbit, Hello Tech, HopSkipStay, SpareHire, and Freelancer take advantage of workers' need to supplement their incomes, stitch together a middle-class income, or just make retirement easier, the number of these positions may grow. Although the inevitable economic cost to society may ultimately be borne by workers' continuing to work well into traditional retirement years (age 66 and older), financial providers may have a unique opportunity to serve this segment with products and services specifically for the Gig-Economy workers.

Sponsors may request trends and profiles of any Gig-Economy segments at any time. Gig-Economy Workers Segment Summary profiles households in this growing work lifestyle.

Contact CFD today to learn more about households receptive to Gig-Economy Workers Segment Summary.