MacroMonitor Market Trends Newsletter April 2017

If you are not a MacroMonitor sponsor but would like more information about this topic, please contact us.

How Households Prepare Their Taxes

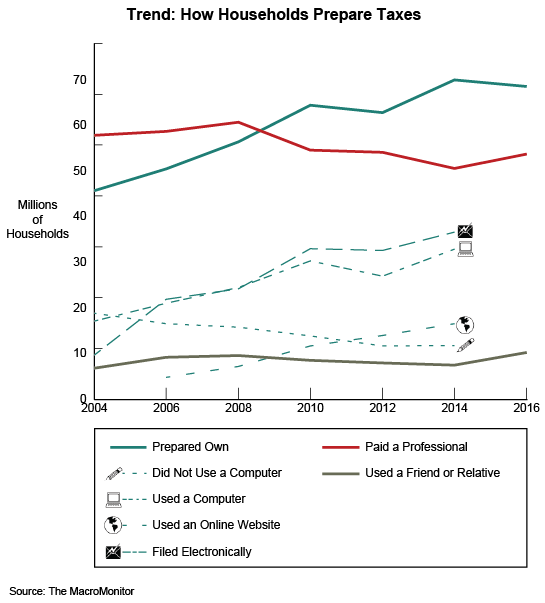

Spring arrives with colorful blooms, allergies, and tax time. Although much-needed tax reform has yet to materialize, in the past decade a significant change has occurred in how people prepare their taxes: the use of personal computers and the internet for tax preparation and online and electronic filing. Regardless of the technology in use, only three ways exist to prepare taxes: Do it yourself, have someone else prepare them free of charge, or pay someone to prepare them (percentages add to more than 100% because many households have more than one person filing taxes).

Of the various ways in which people prepare their own taxes, the old-fashioned pencil-and-paper method is declining; online, electronic, and PC-based methods are increasing. The proportion of households that have a friend or relative prepare their taxes has increased slightly in pace with population growth; overall, this proportion has remained fairly consistent. In the same period, the proportion of households paying someone else to prepare their taxes has declined slightly, although the actual number doing so has increased since 2014. The proportion of do-it-yourself households has increased significantly since 2004. The time-honored tradition of do-it-yourself tax preparation—complete with flurries of receipts, W-2s, 1099s, various forms and schedules and the frustration of missing items, and numbers that just don't add up—has increased much more than can be attributable to increased population.

Many reasons explain the increase in the number of do-it-yourselfers. For example, the ease of the IRS's online-submission service, the digital fluency of younger households, Millennials with simple taxes, and the growing sophistication of tax software. Some institutions are even offering free tax-preparation services in exchange for a charge for state returns. Some institutions view tax preparation as a loss leader for attracting potential clients for financial planning and other investment services. Still other institutions understand that tax-preparation services are a simple way to retain existing customers and to learn more about their finances—taxes are a fairly accurate annual "report card" of households' debts, assets, and cash flow. Tax returns provide insights into a filer's financial responsibilities and challenges and provide an appropriate opportunity for an institution to make suggestions to protect and prepare for the household's future.

Institutions interested in learning about households' differences by tax-preparation methods should contact us for more information.

To learn more, contact us. From their CFD client-landing page, MacroMonitor subscribers may:

- Access the April 2017 Segment Summary, Household Differences by Tax-Preparation Method.

- View the April 2017 Quick Stats, Trend: How Households Prepare Taxes.

- Schedule a full presentation about these households, including a customized and proprietary Q&A session. Contact us to schedule your presentation.