MacroMonitor Market Trends Newsletter October 2016

If you are not a MacroMonitor sponsor but would like more information about this topic, please contact us.

Financial Differences by Party ID

Differences in party positioning, policy bickering, and economic philosophy make clear that Republicans, Democrats, and Independents rarely see eye to eye. Party ID appended to our MacroMonitor respondents from the GfK KnowledgePanel® allows exploration of the real differences in financial behaviors and attitudes that exist between various political (and nonpolitical) households. No difference exists in the primary household head's mean age between Republicans, Democrats, and Independents: All average 52 to 53 years. However, differences by party ID are significant in mean total annual household incomes. For example, Republican households have a mean annual income of $88K, Independents have $52K, Democrats have $42K, and households that profess no party preference have $33K.

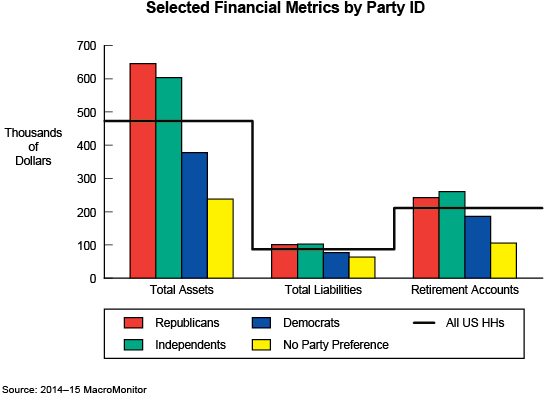

This "ladder effect" is evident in other financial measures as well. Total assets, total liabilities, and total balances in household retirement accounts follow the same pattern: Republicans have the highest mean amounts and No-Party-Preference households the lowest mean amounts. Not surprisingly, the party-ID order—Republicans, Independents, Democrats, and No-Party-Preference households—carries through with charitable contributions as well. In comparison with the total annual charitable donations of $1,473 from all households, Republicans give a mean amount of $2,419, Independents $1,562, Democrats $982, and households with no party preference $760.

Other descriptive characteristics that differentiate households by major-party ID include home ownership (Republicans 76% versus Democrats 58%), living in a single-family home (Republicans 73% versus Democrats 56%), and the type of area in which they live: a large city (Republicans 8% versus Democrats 23%), in comparison with a small city, town, or rural area (Republicans 40% versus Democrats 23%).

The differences in (households that agree with) the three attitudes below by party ID shows how the applications of economic philosophy come into play.

| Attitude | All US HHs (Percent Agree) | Republican (Percent Agree) | Independent (Percent Agree) | Democrat (Percent Agree) | No Party (Percent Agree) |

|---|---|---|---|---|---|

Source: 2014–15 MacroMonitor |

|||||

| When it comes to investing, getting the highest return for the lowest risk is the most important factor. | 89 | 89 | 89 | 91 | 86 |

| I would be willing to make less money in order to invest in companies that are socially responsible. | 42 | 37 | 44 | 48 | 37 |

| My household prefers to invest in companies that have a sound record of protecting the environment. | 56 | 44 | 53 | 66 | 58 |

Agreement is virtually universal with the first attitude: "Investing involves getting the highest return with the least amount of risk." Roughly two-thirds of Republicans (65%) in comparison with somewhat more than one-half of Democrats (55%) are likely to accept an average or higher level of risk to secure an average or higher level of return on investments. However, Republicans (37%) are less likely than Democrats (48%) or Independents (44%) to accept a lower return to invest in companies that are socially responsible. At the same time, Democrats (66%) are more likely than Independents (53%) or Republicans (44%) to say they would invest in companies that have a sound record of protecting the environment.

The October Segment Summary—Financials by Political-Party ID—details the differences and similarities between households of the three major political parties. Insights include demographics, financial-product-and-service ownership, institution and intermediary use, trust, and selected financial attitudes.

Institutions interested in learning more about the financial behaviors and attitudinal differences by political-party identification should contact us for more information.

If this market segment is important to the future of your business:

From their CFD client-landing page, MacroMonitor subscribers may:

- Access the October 2016 Segment Summary, Financials by Political-Party ID.

- Schedule a full presentation about these households, including a customized and proprietary Q&A session. Contact us to schedule your presentation.