MacroMonitor Market Trends Newsletter July 2016

If you are not a MacroMonitor sponsor but would like more information about this topic, please contact us.

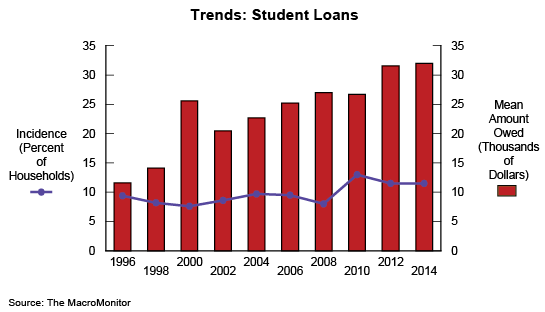

Student-Loan Debt

In 2012–13 the MacroMonitor reported that 11.5% of US households were paying off an education loan; in 2014–15, the number rose slightly to 12%. An April 2016 College Board study finds that two-thirds of college graduates have student-loan debt. Although a college education no longer guarantees employment, a graduate will experience, on average, lower unemployment and higher wages during his or her lifetime than did college graduates a decade ago.

Graduating is the key. The New York Times (2 July 2016) reports only 55% of students attending "private, nonprofit colleges graduate within six years"; the graduation rate for students attending public colleges is only 46%. Some college dropouts have a student loan but not the ability to repay. In 2013, the Department of Education reported that one in ten recent borrowers defaulted on a student loan in the first two years—the highest default rate since 1995 (the default rate includes loans to attend for-profit colleges). Homeowners, corporations, and even countries may file for bankruptcy, but student-loan borrowers may not.

The MacroMonitor finds that of the 14% of households that are currently paying off student-loan debt, 44% have a private loan, in comparison with 82% that have a government education loan—4 million households have both.

Beginning in summer 2016, the federal interest rate for undergraduate-student loans for the upcoming academic year (3.76%) will be lower than it was a decade ago (6%), declining from 4.29% a year ago. Lower interest rates will help new borrowers. Penalties for people who default remain onerous: Employers may garnish wages, the government can withhold income-tax refunds, and lenders can sue borrowers to collect loans.

The burden of student-loan debt continues to inhibit Millennials' desire and ability to buy homes, vehicles, and other necessary products as households form and Millennials establish families. Millennials are not the only households affected by student-loan debt. More than one-quarter of households paying student loans have heads age 50 and older—an age at which households traditionally focused on saving for retirement. Ironically, borrowing in order to secure a better-paying job to afford the better things in life may burden a household to the extent that it may delay household formation, development, and even retirement.

The July 2016 Segment Summary, Households with Student Loans, highlights demographics, financial balance sheet, institutional use, and financial attitudes of households saddled with student loans.

Also see the August 2014 MacroMonitor Market Trends Newsletter, Education-Loan Debt Is Delaying the American Dream.

If this market segment is important to the future of your business:

From their CFD client-landing page, MacroMonitor subscribers may:

- Access the July 2016 Segment Summary, Households with Student Loans.

- View the July 2016 Quick Stats, Trend: Households with a Student Loan.

- Schedule a full presentation about these households, including a customized and proprietary Q&A session. Contact us to schedule your presentation.