MacroMonitor Market Trends Newsletter June 2016

If you are not a MacroMonitor sponsor but would like more information about this topic, please contact us.

Are Annuities the New Life Insurance?

In 2010, the Life Insurance Management Research Association reported ownership of individual life insurance had hit a 50-year low; MacroMonitor data confirmed that finding. Many theories exist about why the decline is happening, including the declining value proposition of life insurance, the increase in dual-earner households, and the shift in financial priorities.

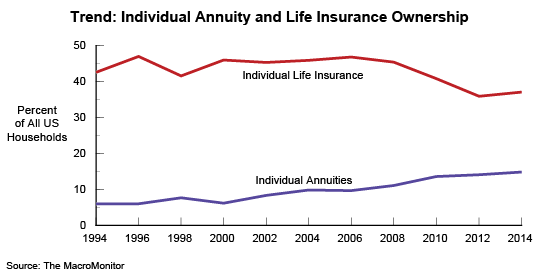

The MacroMonitor has collected information about the financial attitudes, behaviors, and needs of US households since 1978. This breadth of information allows us to produce ownership trends for virtually every financial product and service offering during this time. Plotting ownership of individual life insurance against ownership of annuities for the past two decades produces an interesting trend.

In 1994, only 1 in 20 (6%) US households owned annuities; just fewer than half (46%) owned individual life insurance. In 2014, annuity ownership is 15%, and the proportion of households owning life insurance is down to 37%.

In 1992, 69% of annuity owners also owned life insurance; just one in ten life insurance owners also owned annuities. Currently, the proportion of annuity owners who also own life insurance is less than 50%; the proportion of life insurance owners who also own an annuity has doubled to one in five households.

The average age of an annuity-owning household head was 56 years in 1994. In 2014, although the average age of the primary head of household has increased by two years among the entire US population, the average age of an annuity owner has increased by just one year to age 57. In comparison, the average age of insurance-owning household heads was 51 in 1994; in 2014, the average age has increased by four years to age 55. The average age of household heads who own life insurance is increasing more quickly than is the average age for heads who own annuities.

In the twentieth century, the goal was to live long enough to afford to retire; in the twenty-first century, the goal is to retire with enough resources to afford to live long! It is clear that annuities are gaining momentum; unclear are among whom and why? Some of the growth is demographically driven because of the size and Life Stages of the Boomers. Are life insurance sales growing among Millennials? Millennials are a larger cohort than the Boomers, and are in the Life Stages in which people buy life insurance. To understand additional factors that may be influencing the increased appeal of annuities and the waning interest in life insurance, financial-services companies must understand the changes in the households purchasing (and not purchasing) these products relative to their other financial needs and shifts in their underlying financial goals, priorities, preferences, and attitudes. The MacroMonitor provides this information.

If this market segment is important to the future of your business:

From their CFD client-landing page, MacroMonitor subscribers may:

- Download the June 2016 Executive Report, Changes and Challenges in Annuities and Life Insurance.

- View the June 2016 Quick Stats, Trend: Individual Annuities and Life Insurance Ownership.

- Schedule a full presentation about these households, including a customized and proprietary Q&A session. Contact us to schedule your presentation.