MacroMonitor Market Trends Newsletter March 2016

If you are not a MacroMonitor sponsor but would like more information about this topic, please contact us.

Women's Financial Attitudes: Still Different from Men's

In the book Men Are from Mars, Women Are from Venus, author John Gray says communication styles and emotional needs differ vastly by gender: "Just as a man is fulfilled through working out the intricate details of solving a problem, a woman is fulfilled through talking about the details of her problems."

The MacroMonitor looks at more than 25 financial needs, and when it evaluates their importance by the gender of the respondent, the needs confirm John Gray's premise: Women are different from men.

The financial-services industry still has a gender problem. The design of most—if not all—of the products and services the industry uses comes from a man's point of view; most products and services originated from the 1950s or earlier when men were the providers and women the homemakers. Whether the subject is advice to investors about how to select and sell investments, how consumers approach saving, how they prioritize their goals, how much life insurance they need, how and when they borrow, what factors are important for choosing an advisor, where to keep their money, or even training for advisors, the financial-services industry tends to think like a man thinks.

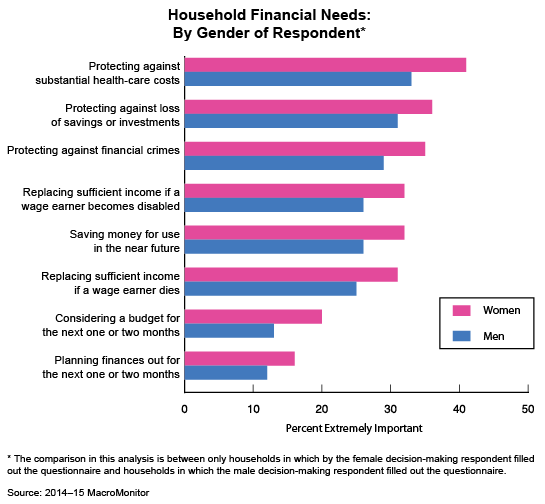

The differences in the figure illustrate a pattern: Women place more importance on issues related to income security, protection, and short-term solvency and budgeting, not on balancing risk while maximizing returns, long-term planning, or leverage. And results from filters on households with incomes of $50,000 or more or net worth of $250,000 or more indicate that the same patterns persist. Clearly, products that provide protection for savings and income and assist with savings and planning for the short term will resonate stronger with women than with men.

The MacroMonitor also tracks the usefulness of a household's current products in meeting its most important needs, as well as a host of other financial attitudes. The Executive Report, Women's Financial Attitudes: Still Different, goes into the differences in institutional use and trust attitudes, investment attitudes, retirement attitudes, credit-use attitudes, life insurance attitudes, health and other insurance attitudes, and financial advice, advisor use, and trust attitudes.

Today's women are just as likely as men to work, earn their own money, have their own assets, do their own borrowing, buy their own insurance, and seek their own advice. To market to the needs of Venusians, financial-services companies need to go beyond their Martian perspectives and understand the unique and different needs of each population.

If this market segment is important to the future of your business:

From their CFD client-landing page, MacroMonitor subscribers may:

- Download the March 2016 Executive Report, Women's Financial Attitudes: Still Different.

- Schedule a full presentation about these households, including a customized and proprietary Q&A session. Contact us to schedule your presentation.