MacroMonitor Market Trends Newsletter February 2016

If you are not a MacroMonitor sponsor but would like more information about this topic, please contact us.

Peer-to-Peer Lending and Borrowing

Growth of the "sharing" economy (collaborative consumption) does not exclude the financial-services industry. Online firms such as LendingTree, Prosper, Lending Club, and People Capital have all staked a claim on the financial-services industry's profits by using technology to bring together households with financial needs and households willing to meet those needs. The low-interest-rate environment, coupled with traditional lenders' desire to minimize risk, has led some borrowers to find funds elsewhere. At the same time, investors—unsatisfied by low, single-digit returns and willing to take on some risk—are looking for alternative sources of rewards. Innovative start-ups are finding ways to bring together borrowers and investors, facilitate their mutual objectives efficiently, and turn a profit in the process.

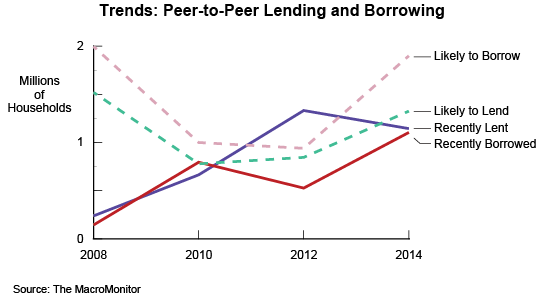

Since before the 2008–09 Great Recession through 2014, the current MacroMonitor identifies households that recently used (or are likely to use) peer-to-peer borrowing and lending services.

Interest in peer-to-peer (P2P) services was high just before the recession—nearly 2 million households in 2008 reported they were likely to borrow; 1.5 million reported interest in lending in the next 12 months. By 2010, interest had declined as the recession's effects were strongest. Actual use of peer-to-peer services in the past two years more than doubled between 2008 and 2010. In the most recent measurement in 2014, use of peer to-peer borrowing and lending has increased to more than a million households. Interest in use of peer-to peer financial services has almost returned to 2008 levels.

P2P lenders are willing to take on some risk; borrows are looking for alternative methods to borrow. However, both lenders and borrowers indicate they would like to go to just one person and would prefer to do business with a single financial-services company that provides more of their financial needs. Do P2P services represent a threat to traditional financial institutions that offer personal loans?

If this market segment is important to the future of your business:

From their CFD client-landing page, MacroMonitor subscribers may:

- Access the February 2016 Segment Summary, How Real Are Peer-to-Peer Service Threats?

- Schedule a full presentation about these households, including a customized and proprietary Q&A session. Contact us to schedule your presentation.