MacroMonitor Market Trends Newsletter December 2015

If you are not a MacroMonitor sponsor but would like more information about this topic, please contact us.

Divorced Households

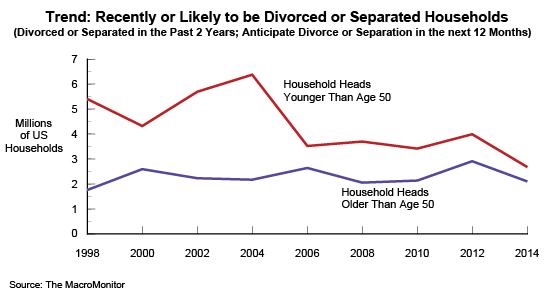

If you know where to look, some disruptive life events may offer business opportunities. Divorce is not only an emotionally disruptive event; it also changes the financial well-being of household members. In 2014, roughly 15.5 million divorced households are in the United States; an additional 4.4 million are separated. The effects of divorce and separation on finances are immediate and often long lasting. For example, financial relationships, financial product and service ownership, and assets suffer effects, and changes in cash flow are immediate. The results of divorce may be more profound for mature households than for younger households because of impending retirement.

Between 1992 and 2014, the overall proportion of US divorced households remains at about 12%. However, in 1992, the number of divorced households with heads age 50 and older was lower than for younger heads (younger than age 50); in 2014, the number of divorced heads age 50 and older is three times that for households with younger divorced heads (12 million versus 4 million households). Also notable is the significantly higher number of divorced women age 50 and older (7.1 million) than men of the same age (4.5 million).

MacroMonitor data suggest that men are more likely than women to remarry; although incidences are small, men age 50 and older are twice as likely as women age 50 and older to expect to remarry in the next year. Recently divorced or separated households—or households anticipating a divorce or separation—present a window of opportunity for financial-services providers as these households reorganize their finances.

Divorce affects women heads older than age 50 differently than it does men heads older than age 50 because women tend to live longer, have lower lifetime earnings, and continue as caregivers throughout their lives. Further, because large numbers of women didn't enter the work force until the 1970s, many women age 65 and older didn't learn to manage household finances on their own; as a result many lack experience and confidence. Attention to their needs, and patience when providing information and advice, can net a largely overlooked and untapped market of loyal customers interested in saving and investing to protect their future.

If this market segment is important to the future of your business:

From their CFD client-landing page, MacroMonitor subscribers may:

- Access the December 2015 Segment Summary, Divorced and Older Than Age 50.

- View the December 2015 Quick Stats, Trend: Divorced or Separated Household Heads.

- Schedule a full presentation about these households, including a customized and proprietary Q&A session. Contact Us to schedule your presentation.