MacroMonitor Market Trends Newsletter April 2015

The MacroMonitor Market Trends Newsletter from Consumer Financial Decisions (CFD) highlights topical news and trends of interest to you and your colleagues.

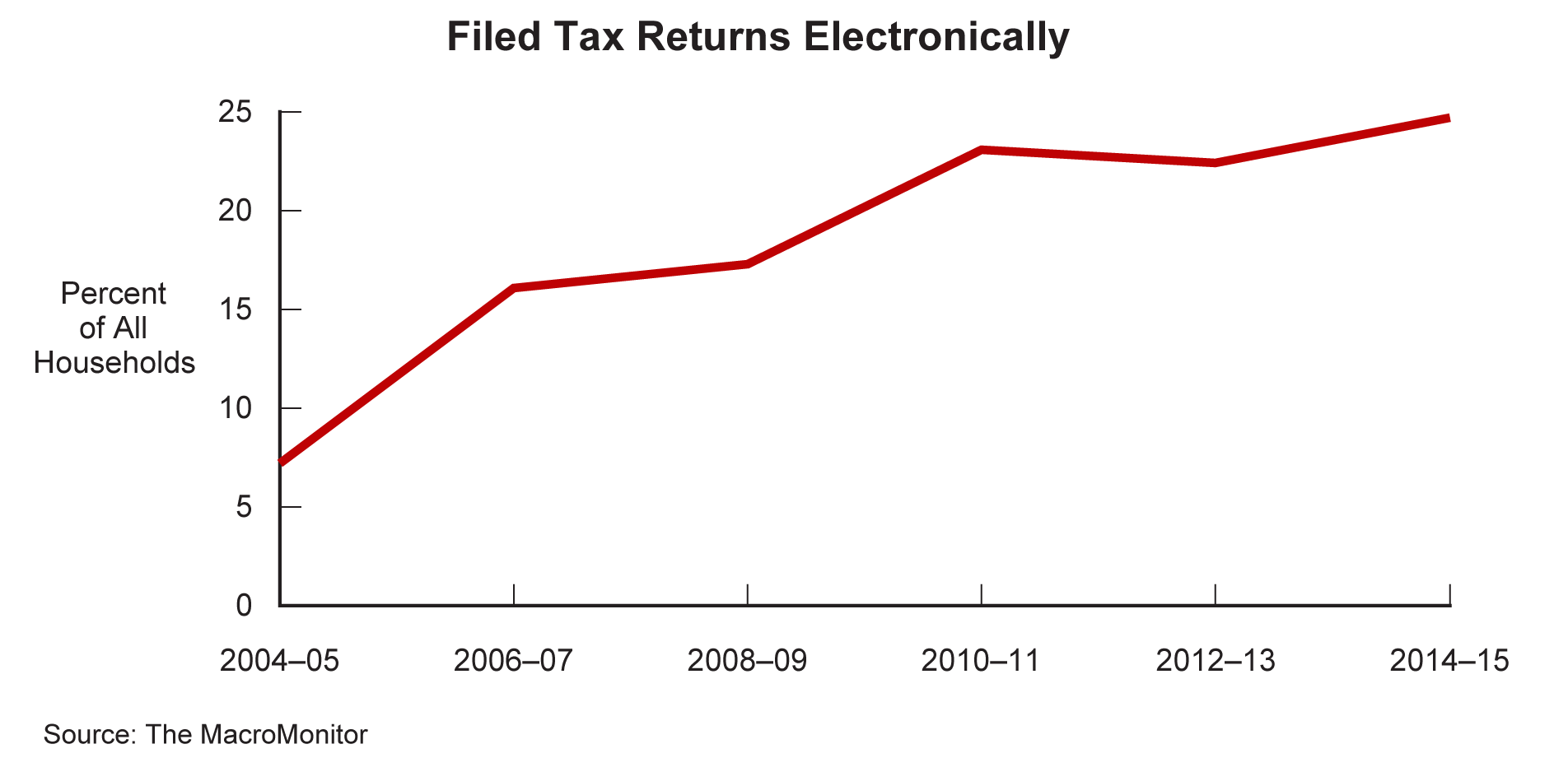

Households That File Income Taxes Electronically

Death and taxes are constants. Since 1955, we have been able to pin the latter to a specific date each year: 15 April. In 1986, US the Internal Revenue Service took advantage of increased computer use by taxpayers to implement electronic filing as a cost-saving measure; the following year, it added electronic direct deposit.

Despite the increase in tax-code complexity, ubiquitous internet access—93% of US households have access—enables a growing proportion of households to file income tax returns easily, electronically eliminating the need for a trip to the post office. For households expecting a tax refund, direct deposit not only provides an incentive to file electronically but also eliminates the need for a trip to the bank.

In 2004–05, MacroMonitor reported that only 7% of households (approximately 8.7 million) filed taxes electronically. Between 2010–11 and 2012–13, the incidence of households' filing electronically (from 23.1% to 22.4%, respectively) remained fairly stable at 29 million households. However, the 2014–15 MacroMonitor reports an increase in electronic-tax-filing households to one-quarter (24.7%), or 33 million households.

Interestingly, it is not the archetypical young, single filers who dominate the electronic filers; almost half are older than age 50. Fewer electronic-filer households file an individual return (45%) than file a joint return (55%). Of households that used online financial services in the past two years, 77% filed an e-return; 75% used a computer to do so. The difference between the proportion of households that filed electronically and the proportion that used a computer is households that used a smartphone (1.4%) or a tablet (2.6%) to e-file. As desk-free devices gain wider use for financial services, the number of e-filer households using mobile devices will increase. Although electronic tax filing can be an annual event, these e-filer households are good prospects for other critical financial services whose delivery is through well-designed, convenient, and simple technology.

If this market segment is important to the future of your business:

From their CFD client-landing page, MacroMonitor subscribers may:

- Access the April 2015 Segment Summary, Tax E-Filing Households.

- Schedule a full presentation about these households, including a customized and proprietary Q&A session. Contact us to schedule your presentation.

If you are not a MacroMonitor subscriber but would like more information about households that file their income taxes electronically, please contact us.