MacroMonitor Market Trends Newsletter October 2014

The MacroMonitor Market Trends Newsletter from Consumer Financial Decisions (CFD) highlights topical news and trends of interest to you and your colleagues.

Concerns about Identify Theft Are Increasing

"Identity theft and identity fraud are terms used to refer to all types of crime in which someone wrongfully obtains and uses another person's personal data in some way that involves fraud or deception, typically for economic gain," according to the US Department of Justice. Information from a range of public and private resources (www.identitytheft.info/victims.aspx) estimates that each year approximately 15 million US residents experience misused identities, and another 100 million are at risk through government and corporate databases. Industry sources estimate an aggregate loss (to corporate and individual victims) of $50 billion to $54 billion annually; 7% of all adults lose about $3,500 each. ID theft will likely grow as the economy and consumer spending improve and the number of electronic transactions and records continues to increase.

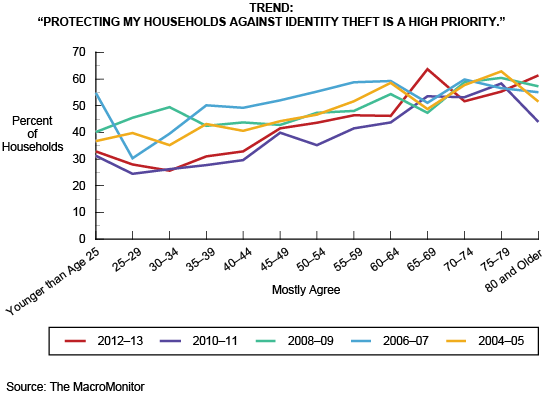

Concern about identity theft peaked in 2006, when 52% of households mostly agreed it was a high priority. By 2010, identity-theft protection (as a priority) declined to 38% of households, when for most people, economic concerns brought on by the recession outweighed concerns about all other issues. Then, in 2012, when the Edward Snowden leaks of US National Security Agency documents dominated the news, identity-theft protection as a household priority increased to 42%. Retailer-data breaches during the 2013 Christmas-selling season and more recently and Russian-hacker attacks—among other events—will influence 2014–15 MacroMonitor responses about ID theft as a priority.

A correlation exists between the age of the household head and concerns about protecting the household against identify theft. Younger household heads are less concerned than are older heads. A number of reasons—such as awareness, experience, and the amount of money potentially at risk—may contribute to this effect. Although credit-card companies typically have protections in place by monitoring unusual account activity and when people report stolen cards, 28% of household heads cite ID-theft protection as an important reason for the household to change to a new credit card. Whether the soon-to-be widespread introduction of credit cards with embedded computer chips will alleviate ID-theft concerns is unclear. Financial institutions may want to be proactive about ID-theft concerns. An increased understanding of households most worried about identify theft will enable institutions to create more effective messages for appropriate target households.

If this market segment is important to the future of your business:

MacroMonitor subscribers may:

- Access the October 2014 Segment Summary, Households Concerned about ID Theft.

- View Quick Stats to find the numbers behind the figure in this newsletter.

- Schedule a full presentation about these households, including a customized and proprietary Q&A session. Contact us to schedule your presentation.

If you are not a MacroMonitor subscriber but would like more information about households that are concerned about identity theft, please contact us for package information and pricing.