MacroMonitor Market Trends Newsletter March 2014

The MacroMonitor Market Trends Newsletter from Consumer Financial Decisions (CFD) highlights topical news and trends of interest to you and your colleagues.

Retirement: A Late-Twentieth-Century Anachronism

For the majority of households, retirement—as we've defined it for the past six decades—is a late-twentieth-century anachronism: The majority of households can no longer afford to retire successfully (see the March 2013 and November 2013 newsletters). The reasons are numerous. For example, because of increased life expectancy, more people can expect to spend more years in retirement; consequently, higher assets are necessary than previously. Significant increases in financial assets and real-estate values have helped only some household heads stay on track to retire at age 65. Increasing medical expenses—the reason many retired households fell into crippling debt in the past—have been somewhat offset by the passage of Medicare in the mid-1960s. The change from occupational pension plans to defined-contribution pension plans has been a boon for many employers but less so for nonunion employees; many union employees with pension plans, such as police officers and firefighters, will not receive guaranteed, promised benefits, because the majority of plans are underfunded. Defined-contribution plans (401(k)s, 403(b)s) from about 1980 have seen negative effects as each year more employers cut matching contributions. Since the 1970s, when wages began to lag productivity gains, stagnating wages have resulted in many households' inability to save enough to retire. Increased cost-of-living expenses negate small wage increases.

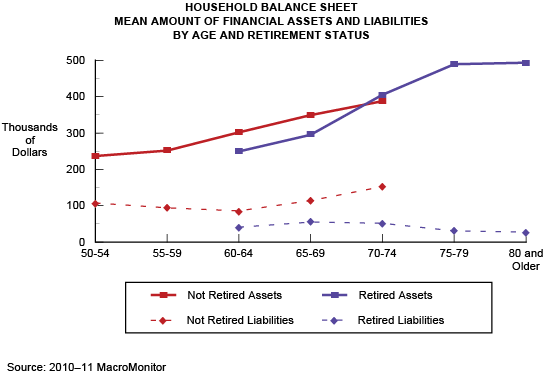

A comparison of households' assets and liabilities shows that nonretired household heads older than age 60 maintain higher levels of debt than retired households in their sixties do; sometimes high liabilities are present even when nonretired households have more than sufficient assets to pay off debt. Retired household heads continue to amass assets as liabilities, and spending decreases.

Many developed countries are rethinking retirement age. In the United States, one result is that retirement age is evolving from starting at a well-defined age (between the ages of 65 and 67) to starting when both household heads are no longer employed. For the majority of households, the 15-year period when the primary head is between 60 and 75 years old is fraught with uncertainty and concern about the ability to retire financially and concern about the physical ability to continue working. Few, if any, financial products currently available provide households with tools necessary for current retirement. When marketplace change occurs, opportunity exists for the financial-services industry.

If this market segment is important to your business:

MacroMonitor subscribers may request a package of custom, edited data tables and charts that profile nonretired and retired households.

In addition, from their CFD client-landing page, subscribers may:

- Access the March 2014 Segment Summary, Retirement Status of Households Older and Younger Than Age 65.

- Download the March 2014 Dirty Dozen—a dozen annotated graphic-analysis slides that pertain to retirement-age households.

- View Quick Stats for charts comparing retirement-age households' average cash-flow.

- Schedule a full presentation about these households, including a customized and proprietary Q&A session. Contact us to schedule your presentation.

If you are not a MacroMonitor subscriber but would like more information about nonretired and retired households, please contact us for package information and pricing.