Twenty-First–Century Retirement: The Revolving-Retired Life Stage MacroMonitor Marketing Report Vol. VI, No. 3 June 2003

The Revolving Retired display characteristics that place them between the Preretired and the traditional Retired in terms of their age, marital status, and income. Their financials place them near the top of the fiscal ladder, just below the Preretired. Their retirement products and balances provide at least half of the motivation for delaying retirement—they are uncertain if they have enough assets to last. Certainly, some of this motivation was aggravated by the market's declines in the past few years. Given their recent change in employment status, the Revolving Retired are reacting logically and appropriately to their situations.

Attitudinally, the Revolving Retired paint an interesting picture of a life stage that has some of the beliefs of the Preretired, some of those of the Retired, and some of their own. Like the Preretired, they tend to be receptive to interactions with intermediaries: retaining control, but willing to discuss options, receive suggestions, and generally stay informed. They are open to suggestions of products and services that are tax deferred or tax exempt. They are particularly interested in consolidation of services, setting up automatic transactions, and using the Internet. They tend to trust depositories the most, insurers next, and only some of the investment channels. They exhibit markedly higher levels of trust for most intermediaries than do other post–child-rearing life stages and have used representatives of depositories, directly hired professionals, some brokers, and insurance agents more often. And the Revolving Retired are more likely than the other 55+ No Kids groups to have recently obtained financial planning and advice in most areas except for debt consolidation and educational financing.

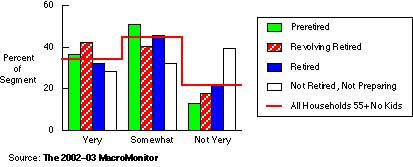

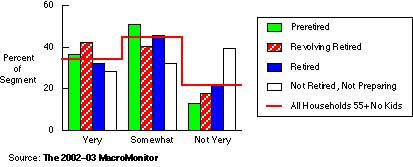

CONFIDENT THAT HOUSEHOLD WILL REACH ITS MOST IMPORTANT FINANCIAL GOALS

Given their greater trust and use of financial institutions, intermediaries, and advisors, it's no wonder that the Revolving Retired are more likely to say that they are very confident of achieving their major financial goals than are other 55+ No Kids segments. But this confidence is not based on just the households' ability to make decisions. Their more collaborative approach gives them a firmer foundation on which to base this confidence. Their recent financial activities display more than simply increased investing in stocks, bonds, CDs, and money markets. They also show a tendency to open checking, savings, and other types of relationship-based accounts. And their transaction activity suggests that although they are not as active as the Preretired, they have yet to assume the more sedentary lifestyle associated with the Retired.

Several challenges are inherent in serving the needs of the Revolving Retired. First, because this life stage is evolving, early indicators are only a precursor of potential activity. As more Boomers move into this life stage, their greater numbers may alter the early tendencies and change the mixture of products and services that the Revolving Retired use. Second, until this life stage gains widespread recognition, member households will be somewhat unaware that their needs are different. The Revolving Retired may expect their financial institutions to be able to provide them with services just as they do for Preretired or Retired households. Third, because financial institutions have preconceived notions of what products and services are appropriate for people in the Preretired and Retired life stages, or because they have decided to focus on the Retired or the Preretired only, they may not offer the optimal selection of products or provide services through the expected channels for the Revolving Retired. Because Revolving-Retired households' situations are more dynamic than those of other life stages, these households require more flexibility and, until their needs become routine, more interaction and personal service.

The evolving Revolving-Retired life stage promises to be extremely beneficial and profitable to financial-services providers. In addition to having general affluence, the Revolving Retired need a wider diversity of products and services than either the Preretired or the traditional Retired need. What's more, the initial indication from people who are in this life stage is that the flexibility, collaboration, personal interaction, and complexity inherent in their financial services needs are accompanied by greater levels of trust, cooperation, consolidation, and confidence. Those financial providers that identify the correct households and create packages that fit the different needs of the Revolving Retired will position themselves to profit from the tsunami of Boomers as they head into this new life stage.

Attitudinally, the Revolving Retired paint an interesting picture of a life stage that has some of the beliefs of the Preretired, some of those of the Retired, and some of their own. Like the Preretired, they tend to be receptive to interactions with intermediaries: retaining control, but willing to discuss options, receive suggestions, and generally stay informed. They are open to suggestions of products and services that are tax deferred or tax exempt. They are particularly interested in consolidation of services, setting up automatic transactions, and using the Internet. They tend to trust depositories the most, insurers next, and only some of the investment channels. They exhibit markedly higher levels of trust for most intermediaries than do other post–child-rearing life stages and have used representatives of depositories, directly hired professionals, some brokers, and insurance agents more often. And the Revolving Retired are more likely than the other 55+ No Kids groups to have recently obtained financial planning and advice in most areas except for debt consolidation and educational financing.

Given their greater trust and use of financial institutions, intermediaries, and advisors, it's no wonder that the Revolving Retired are more likely to say that they are very confident of achieving their major financial goals than are other 55+ No Kids segments. But this confidence is not based on just the households' ability to make decisions. Their more collaborative approach gives them a firmer foundation on which to base this confidence. Their recent financial activities display more than simply increased investing in stocks, bonds, CDs, and money markets. They also show a tendency to open checking, savings, and other types of relationship-based accounts. And their transaction activity suggests that although they are not as active as the Preretired, they have yet to assume the more sedentary lifestyle associated with the Retired.

Several challenges are inherent in serving the needs of the Revolving Retired. First, because this life stage is evolving, early indicators are only a precursor of potential activity. As more Boomers move into this life stage, their greater numbers may alter the early tendencies and change the mixture of products and services that the Revolving Retired use. Second, until this life stage gains widespread recognition, member households will be somewhat unaware that their needs are different. The Revolving Retired may expect their financial institutions to be able to provide them with services just as they do for Preretired or Retired households. Third, because financial institutions have preconceived notions of what products and services are appropriate for people in the Preretired and Retired life stages, or because they have decided to focus on the Retired or the Preretired only, they may not offer the optimal selection of products or provide services through the expected channels for the Revolving Retired. Because Revolving-Retired households' situations are more dynamic than those of other life stages, these households require more flexibility and, until their needs become routine, more interaction and personal service.

The evolving Revolving-Retired life stage promises to be extremely beneficial and profitable to financial-services providers. In addition to having general affluence, the Revolving Retired need a wider diversity of products and services than either the Preretired or the traditional Retired need. What's more, the initial indication from people who are in this life stage is that the flexibility, collaboration, personal interaction, and complexity inherent in their financial services needs are accompanied by greater levels of trust, cooperation, consolidation, and confidence. Those financial providers that identify the correct households and create packages that fit the different needs of the Revolving Retired will position themselves to profit from the tsunami of Boomers as they head into this new life stage.