The Millionaire Market: Wealth Management in Transition MacroMonitor Marketing Report Vol. V, No. 9 May 2002

Shifts in demographics, lifestyles, and financial attitudes make it necessary for financial institutions periodically to reassess who their best customers are. Customer reevaluation is even more critical when serving millionaire clients, especially in today's volatile and uncertain economic environment. The composition and financial needs of the millionaire market are changing with the passing of the older generation. As old money makes way for new money, the wealth-management business needs to respond to this transition to continue to serve the millionaire market effectively and successfully.

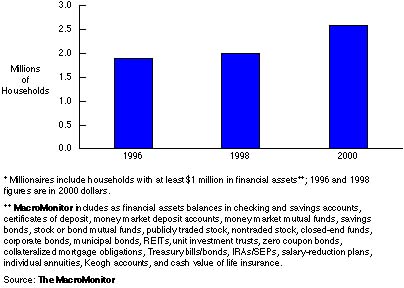

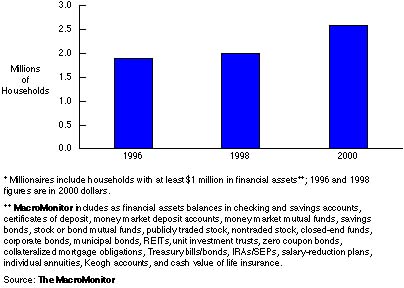

Some 2.6 million U.S. households have financial assets of at least $1 million. In 2000 dollars, millionaire households jumped 30% between 1998 and 2000, a direct result of the exuberant market during this period. We expect the millionaire market not to grow as aggressively, and perhaps even (temporarily) register a decline in numbers, at least for 2002. But the resilience and overall strength of the U.S. economy should foster continued growth in the number of wealthy households throughout this decade and into the future.

Increase in Numbers of Millionaires*

Whatever the state of the financial markets however, demographic and other factors are at work altering the composition and nature of the millionaire market. This MacroMonitor Marketing Report offers some useful insights that can help financial institutions meet the needs of today's and the next generation's millionaires. Three developments will affect the wealth-management business:

As more and more financial institutions focus on the wealthy, market competition has intensified. A smart strategy might be for financial institutions to establish relationships early on in the wealth-creation processthat is, targeting the near millionaires and strengthening financial ties as they move up the wealth pyramid. "Growing your own" as opposed to cherry-picking this small and very competitive millionaire market might well be the strategic move that will ultimately lead to success in capturing a profitable share of the millionaire market.

Some 2.6 million U.S. households have financial assets of at least $1 million. In 2000 dollars, millionaire households jumped 30% between 1998 and 2000, a direct result of the exuberant market during this period. We expect the millionaire market not to grow as aggressively, and perhaps even (temporarily) register a decline in numbers, at least for 2002. But the resilience and overall strength of the U.S. economy should foster continued growth in the number of wealthy households throughout this decade and into the future.

Whatever the state of the financial markets however, demographic and other factors are at work altering the composition and nature of the millionaire market. This MacroMonitor Marketing Report offers some useful insights that can help financial institutions meet the needs of today's and the next generation's millionaires. Three developments will affect the wealth-management business:

- The passing of the mantle of wealth to working Boomer households is strongly evident. Boomers now account for about one-third of the millionaire market, up from 17% in 1996. With this generational transition comes an accompanying shift in how millionaires view and use their wealth.

- The female head of household will increasingly become a critical decision making partner in the millionaire households' financial affairs.

- The Internet has raised the bar for delivering financial services to the wealthy. Not only has it made financial information more widely available and easily accessible, but also it has turned financial transactions, particularly securities trading, into a commodity rather than a special purview of the financial provider. This change puts a premium on other aspects of the financial relationship.

As more and more financial institutions focus on the wealthy, market competition has intensified. A smart strategy might be for financial institutions to establish relationships early on in the wealth-creation processthat is, targeting the near millionaires and strengthening financial ties as they move up the wealth pyramid. "Growing your own" as opposed to cherry-picking this small and very competitive millionaire market might well be the strategic move that will ultimately lead to success in capturing a profitable share of the millionaire market.