Three-Levered Annuity: The Last Retirement Account You'll Ever Need MacroMonitor Marketing Report Vol. V, No. 11 September 2002

Mention the word annuity to most consumers, and their eyes immediately start glazing over. By the time you are three sentences into explaining what an annuity is, either they have fallen asleep or their attention has drifted elsewhere. To make matters worse, a couple of years ago Barron's published an article indicating that an annuity is the fifth-best investment, appropriate only for consumers who need to lose money. Yet fixed annuities are one of the few investments with positive returns in the past two years. And with the right combination of packaging, positioning, pricing, product mix, and presentation, an annuity could be the integral core of the best financial service for the next life stage(s) of Boomers and many others.

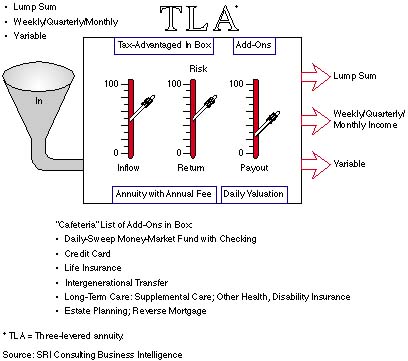

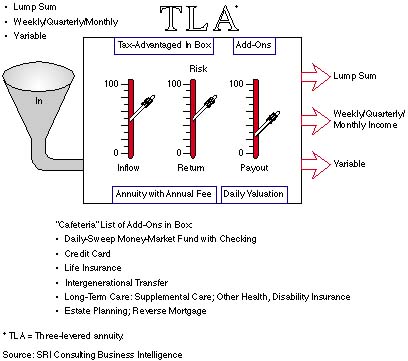

THE THREE-LEVERED–ANNUITY CONCEPT

Because of the large and growing number of people heading into preretirement, a critical need exists for tax-advantaged products with increased flexibility. In addition, because of expanding life expectancy and growing concerns about not outliving one's assets, a new life stage will emerge that that is neither preretirement nor traditional retirement. This phase has its own set of financial needs that involve new products and combinations of existing products. A product that could meet these needs and evolve with the household's changes is the Three-Levered Annuity.

Because of the large and growing number of people heading into preretirement, a critical need exists for tax-advantaged products with increased flexibility. In addition, because of expanding life expectancy and growing concerns about not outliving one's assets, a new life stage will emerge that that is neither preretirement nor traditional retirement. This phase has its own set of financial needs that involve new products and combinations of existing products. A product that could meet these needs and evolve with the household's changes is the Three-Levered Annuity.